Rich Thinking: Canberra Bubble wage delusions spawn a bizarre plan to flatten taxes (MWM Sep 24, 2020)

Sep 28, 2020Forget the “average” wage, half of working Australians earn less than $57,000 a year. Rich think they are poor, poor rich. Elizabeth Minter reports on the government’s strange plan to flatten taxes so everybody who earns between $45,000 and $200,000 pays the same rate.

Think about how much money you made last year. Where do you think that puts you in relation to other Australian workers? Top 25% of income earners? Bottom 25%? Somewhere in between?

I’d wager that you would say somewhere in the middle. Most Australians do. Some 92% say they are in the middle 60% of income earners while 50% think they are in the middle 20%, according to a study by ANU researcher Christopher Hoy.

How much do most Australians earn? Politicians like to refer to average incomes but framing the debate in this way is misleading. Average incomes are skewed high due to the exorbitant wages of chief executives.

Much more informative is the median income – the midpoint of all salaries earned by Australians. According to the Australian Bureau of Statistics, the median salary was $57,000. Some 50% of working Australians earn less than this.

Misconceptions around salaries are common and not inherently harmful. But when politicians, across the board, embrace these misconceptions, the public should start worrying.

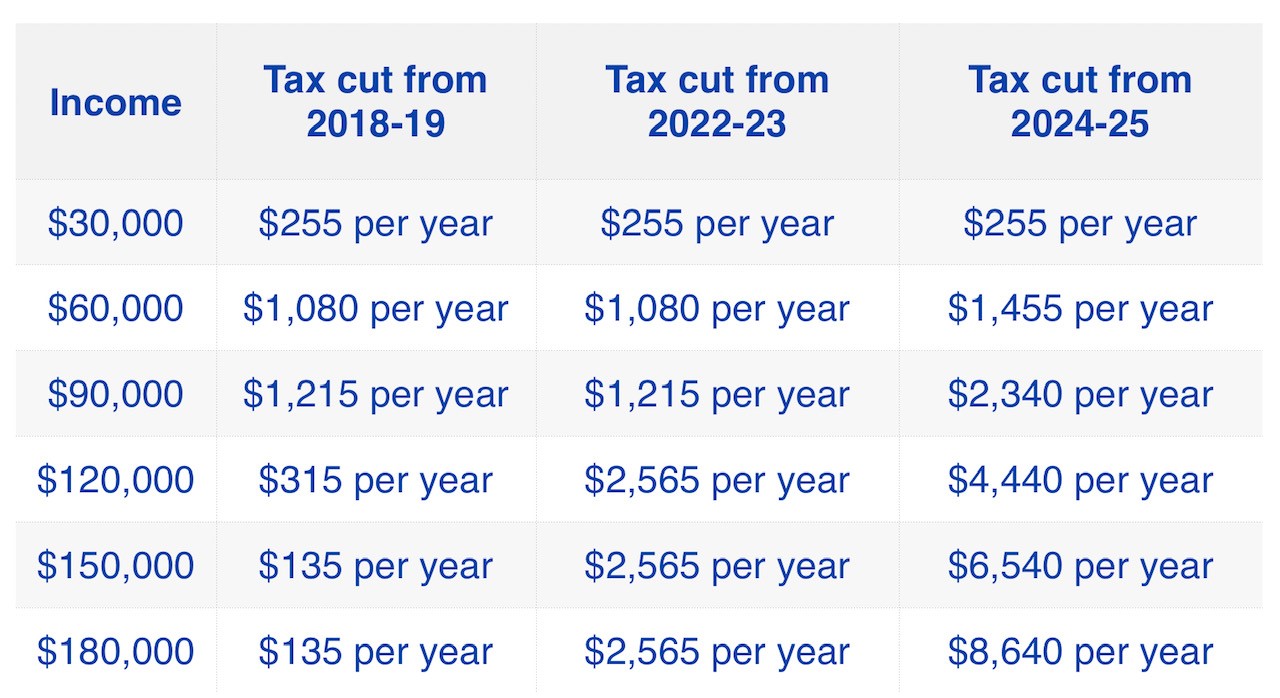

Tax cuts are reportedly the centrepiece of the government’s plan to get the economy back on track. As has been widely noted, the chief beneficiaries are men who earn high salaries and thus have not been affected by the Covid-19 pandemic.

How can the Coalition government proceed with such a policy that goes against any concept of fairness or decency? Legislation that Labor also supported.

With the base salary of a federal MP sitting at $211,250 the only charitable explanation I have is that in the Canberra bubble, politicians have completely lost sight of what most working people earn.

Just 3.4% of all workers earned more than $180,001 in 2017-18. Federal MPs, on their $211,000 base salaries, are clearly in a rarefied atmosphere. Yet Hoy’s research has shown that when it comes to money there’s a tendency for all of us to assume our own experience is typical. Many of the survey respondents, rich and poor, were wildly wrong about how their earnings compared.

“Some very rich people think they are much closer to the bottom of the income distribution than they really are,” said Hoy. “And some people who are quite poor think they are way further up the scale. The misperception was quite striking.”

Further evidence of how out of touch are many high-income earners is found in an Australia Institute survey which revealed that 51% of people who earned between $100,000 and $150,000 a year thought that was what the average Australian earned. One third of those who earned more than $150,000 thought the average Australian earned more than $150,000.

Last year, Labor leader Anthony Albanese said he did not “regard someone who’s earning $200,000 a year as being from the top end of town”.

In May 2015 then prime minister Tony Abbott said that a family income of $185,000 “isn’t especially high” in a city like Sydney. At the time the National Centre for Social and Economic Modelling showed that those with an income of $185,000 were in the top 6% of all family incomes, including single earners.

Labor’s Joel Fitzgibbon noted in 2014:

“Coal miners in my electorate earning $120,000, $130,000, $140,000 a year are not wealthy… In Sydney’s west you can be on a quarter of a million dollars family income a year and you’re still struggling.” (According to the ABS, wages in the mining sector are the highest of any industry in Australia.)

How can someone make three to four times more money than the average Australian and not be “from the top end of town”? How can such a wage be classified as not “especially high”? Are these politicians just trying to convince themselves they still represent the interests of the average Australian?

It is also apparent that Australians have gone on a spending spree using debt – with household debt at around 200% of household income, but that is another story.

Consider the framing of the Coalition’s “low and middle income tax offset” which Treasurer Josh Frydenberg’s pushed as the centrepiece of his pitch to voters before the 2019 election.

The “low income” tax offset applies to taxable incomes of up to $66,667. The “middle income” tax offset applies up to those earning $126,000 a year.

Yet half of Australians take home an income that is less than what the Treasurer points to as being the threshold for a low-income; and as only 10% of Australians report income of more than $126,000, this means 90% of earners are considered to have a low or middle income.

Perceptions of what it is to be a “middle income earner” may be skewed because of tax brackets. The top tax rate of 45 cents in the dollar only affects income above $180,000 – maybe people don’t think they are a high-income earner if they aren’t quite in that top tax bracket.

Given that just a few per cent of all workers earned more than $180,001 in 2017-18, the plan to tax incomes between $45,000 and $200,000 at the same marginal rate defies comprehension.

There is also a less charitable explanation. And that is that politicians are contemptuous of people who don’t earn what they consider a decent income and believe it to be due to lower income earners not trying hard enough.

Remember Scott Morrison’s pledge to Australians last year: “If you have a go, you get a go.” Why should the Coalition give a leg up to those not trying hard enough?

Remember in 2015 when then treasurer Joe Hockey advised Australians wanting to buy their first home to “get a good job that pays good money?

“The starting point for a first home buyer is to get a good job that pays good money. If you’ve got a good job and it pays good money and you have security in relation to that job, then you can go to the bank and you can borrow money and that’s readily affordable.”

Again, if you can’t afford to buy a house, you don’t deserve one because you haven’t got yourself a good enough job that pays enough.

Back in 2018, The New Daily asked all federal MPs if they could live on Newstart of $40 a day. Of the 150 lower house MPs, only 22 MPs responded, including three cross-bench MPs and 19 from Labor. According to The New Daily, none of the 76 Coalition MPs responded. All MPs who responded said they could not live on $40 a day and all but one argued the payment should be increased.

Liberal MP Julia Banks claimed she could on live on $40 a day “knowing that the government is supporting me … looking for employment”. Her register of interests showed at the time that she had six properties in an investment portfolio shared with her husband and brother.

But Banks is not an outlier regarding federal MPs and property investing. According to the ABC, publicly available forms show that at least 97 federal members and senators, or their partners, own an investment property, as of 2016. A handful own more than 10, while 50 MPs own more than two investment properties.

The nation’s politicians are well and truly out of touch with the average Australian. They are far more representative of the wealthy few, who benefit disproportionately from their policies.