Dozens of big industries want to plug in to Australia’s first 100 pct net renewable (wind and solar) grid

June 9, 2025

The death of manufacturing? It’s a constant refrain among the conservative nut jobs on Murdoch’s Sky After Dark and within the far right elements of the federal Coalition, who insist that more wind and solar will be the death of industry in Australia.

The opposite turns out to be true. Already the country’s biggest energy consumers, the huge aluminium smelters and refineries, such as Rio Tinto’s Gladstone assets, have made it very clear that without wind and solar, their business has no future beyond the end of the decade. Coal and gas are too costly, and too dirty.

This is now supported by the experience in South Australia, host to the country’s — and arguably the world’s — most advanced renewable grid with a 74% share of wind and solar over the past year and on track to meet its target of 100% net renewables by the end of 2027, in just two years time.

According to ElectraNet, the transmission company that provides the backbone of the state’s grid, there are more than three dozen companies that have made inquiries about setting up major business in the state and connecting into the state grid, with the specific requirement to source zero emissions and low-cost wind and solar.

ElectraNet says the combined load of these 37 big industries amounts to an astonishing 15 gigawatts, more than 10 times the current average load in the state, and five times the maximum demand. Far from killing industry, the state’s transition to renewables is sparking a rebirth.

The assessment is similar to that of Western Australia, which hosts the biggest isolated grid in the world. Its demand forecasts — again focused on new industry seeking low-cost and zero emissions wind and solar — would require some 50 gigawatts of new renewable and storage capacity over the coming decades.

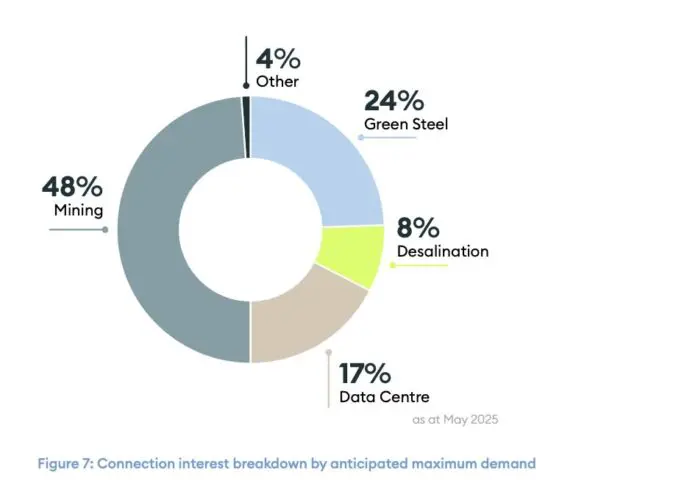

In South Australia, in the decade from 2012 to 2022, ElectraNet says it received interest to connect from just one large industrial load, representing about 50 MW. Now it is being swamped by interest, from miners, green steel companies, data centres and others.

“At present the company has been engaged by a total of 37 individual large industrial customers to explore direct connections to its transmission infrastructure,” it says in its latest transmission planning report.

“Many of these individual customers are requesting connections across multiple projects, indicating that overall potential number of connections to South Australia’s transmission infrastructure is, in fact, much larger than perceived at first glance.

“It is not just the number of customers seeking connection that is important, but also the sheer scale of demand and energy consumption growth represented by these customers.

“The total potential increase in maximum demand, resulting from the new combined load of all 37 of these customers, is over 15,000 MW. This is equal to nearly five times the maximum demand experienced in South Australia during 2024-25.”

ElectraNet says that even if 10% to 20% of the large industrial loads seeking to connect are ultimately connected, this could result in an increase in maximum electricity demand in the range of 1500 to 3000 MW.

ElectraNet says it finds itself at the centre of one of the “once in a generation” challenges and opportunities presented by the energy transition.

“South Australia has one of the most advanced electricity networks in the world, regularly achieving 100% instantaneous variable renewable energy, driven by its world-leading uptake of grid scale renewable energy resources and rooftop solar PV,” it writes.

“When Project EnergyConnect Stage 2 has been fully commissioned, the South Australian electricity system will be able to operate with no conventional generators in service.”

That will be a remarkable achievement, and South Australia will be the first gigawatt scale grid in the world to reach that landmark.

Most grids still have at least some fossil fuel, or hydro generation, working in the background, although in South Australia the amount has been reduced to negligible levels, and often the gas units have to be told to operate. But when the new link is completed, that will often not be necessary.

South Australia also has a country- and world-leading share of rooftop solar, with 50% of homes now generating power from PV on their rooftops, and a growing number of household batteries – about 50,000 to date.

The prevalence of rooftop solar is having an interesting impact on grid demand, and ElectraNet reports that there are multiple days when demand in the middle of the day — when demand was usually high due to air-conditioning and industrial activity — is completely hollowed.

“At times, and more frequently, ElectraNet is even seeing demand become negative, where rooftop solar generates more electricity than the state requires. In fact, 90% of transmission connection points to the SA Power Networks distribution network have experienced times when this has occurred,” it says.

But it also notes that the move to electricity — and movements like Electrify Everything — is starting to have an impact and suggests that the direction of the distribution-connected demand and consumption outlook could reverse.

A lot may depend on the uptake of electric vehicles. South Australia trails other states in the uptake of EVs, but ElectraNet expects EVs to become the default choice for new vehicle purchases by 2040. It expects 170,000 EVs on the road by 2030 and one million by 2040, adding another five terawatt hours to load forecasts over a year.

Republished from Renew Economy, 4 June 2025

The views expressed in this article may or may not reflect those of Pearls and Irritations.