Rising electricity prices have nothing to do with renewables

November 14, 2025

Electricity prices are elevated, but anyone who claims renewable energy has driven the rise is either uninformed or is deliberately lying.

One of those things that ’everybody knows’ is that electricity prices have shot up through the roof, particularly since Labor was elected. And many, particularly those with a partisan bias, believe that electricity prices have risen because of Labor’s renewable energy policy.

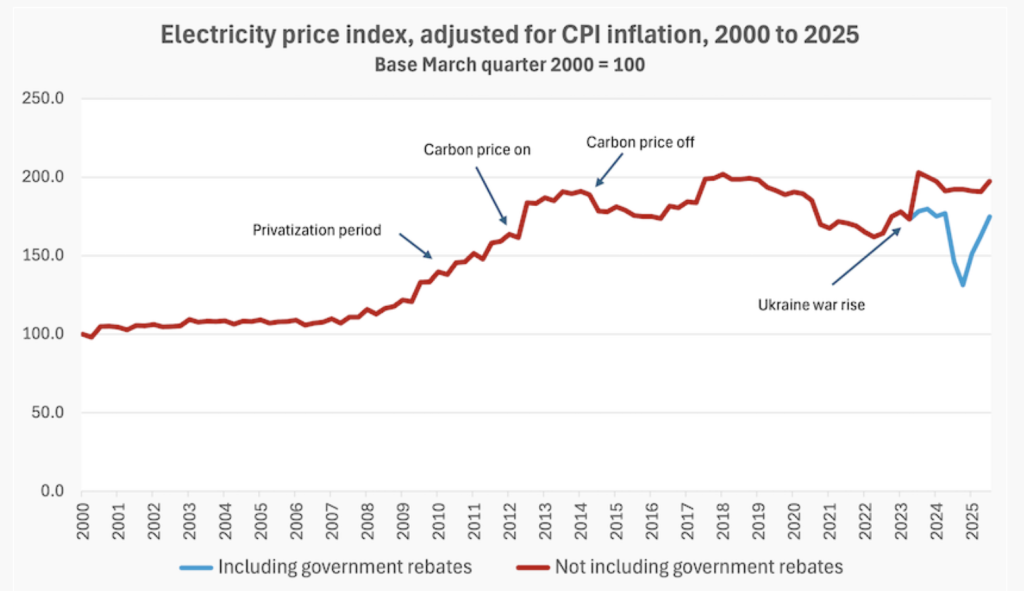

In fact the story of electricity prices is simpler and it has nothing to do with renewable energy. After staying pretty well unchanged in real (CPI inflation-adjusted terms) over an almost 30-year period from 1980 to 2009, electricity prices almost doubled in a short period, and while they have fluctuated, they have remained around that level since.

The graph below shows that big picture, but if we want to consider what’s been driving that doubling and recent fluctuations, the story becomes a little more complicated.

The big rise that kicked off in 2009 corresponded with privatisation, under the ill-advised National Electricity ‘reforms’, designed by a bunch of economists who wouldn’t have known the difference between a transformer and a capacitor, but who were fully conversant with those abstract Economics 1 supply and demand curves. The extent that price rises were driven by privatisation is disputable, but only a Hayekian zealot would deny that privatisation has led to unnecessary cost and price increases.

Then, in 2012, there was a bump in prices when the Gillard government introduced a carbon price. That bump is evident on the graph, and prices fell in 2014 once the Abbott government, opposed to market approaches to public policy, removed the carbon price. But prices soon rose again, peaking in 2018.

The next bump was in 2023, just after Labor was elected. The Coalition still refers to this as a broken Labor promise, even though journalists can find no record of Labor having promised that Russia would not invade Ukraine. It was rash for Labor to have made a promise that could be blown apart by global events.

As can be seen on the graph household consumers (but not other users) were protected from this rise by a set of Commonwealth and state rebates (the blue line), which are now expiring. But even without the rebates, prices are about the same as their 2018 peak.

There is a degree of political canniness in the government’s timing in withdrawing the rebate. Many people — including journalists who should know better — conflate the price of electricity with people’s electricity bills. As people receive their bills for spring and early summer the bill shock may be softened or even eliminated by their lower use of electricity.

The bigger story, that gets little airing, is that at the wholesale level prices are falling, as reported by the Australian Energy Market Operator in its Q3 2025 Quarterly Energy Dynamics Report. To quote from that report:

In Q3 2025, wholesale electricity prices across the NEM [National Electricity Market] averaged $87/MWh, down 27 per cent from Q3 2024 and 38 per cent from Q2 2025. Lower price volatility and higher renewable output offset the impact of increased operational demand, resulting in average prices of $109/MWh in July and $97/MWh in August. Seasonally lower demand and warmer sunnier weather conditions pushed September prices further down to $53/MWh.

These are wholesale prices. If it weren’t for the cuts taken by the (mainly private) owners of the network (poles, wires and transformers) and by the commission agents called ‘retailers’, you would be paying 8.7 cents per kWh (perhaps 10 cents after GST) for your electricity, down from 11.9 cents last year and 14.0 cents in the winter quarter, rather than the 25 to 35 cents you are paying in your bills.

There are two, or even three, reasons why these wholesale price reductions, resulting from more renewable energy in the mix, are not flowing through to retail prices.

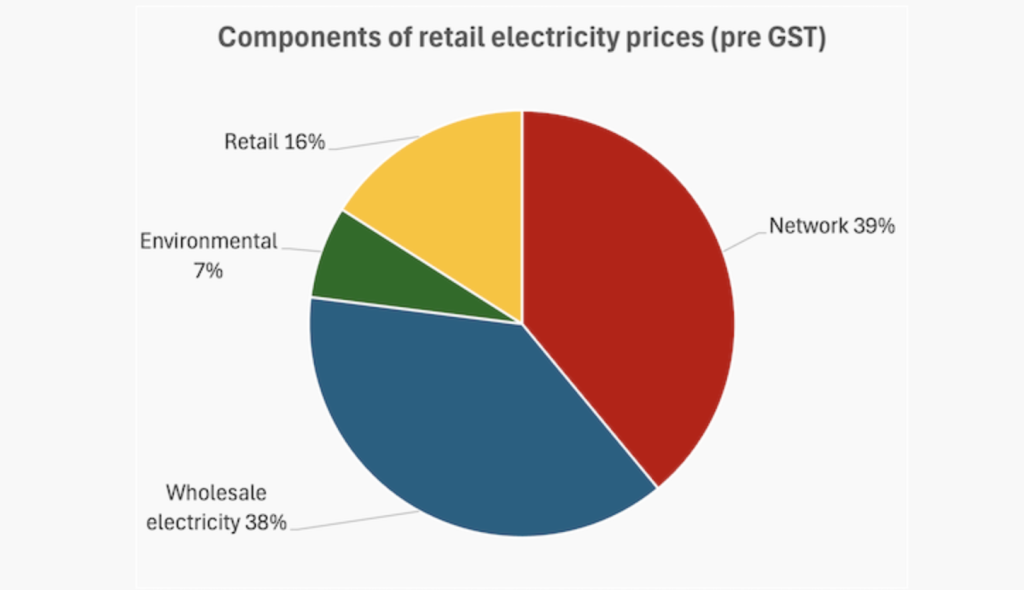

The main one is that wholesale charges are only one part of your bill. The pie chart below, taken from the ACCC December 2024 Inquiry into the National Electricity Market shows the breakup of retail prices. Much of your payment goes to the owners of the network, who, as natural monopolies, are allowed an unjustified generous profit margin to cover their cost of capital. The Reserve Bank’s rises in interest rates over 2022 and 2024 would have contributed to price rises, and it is now too early to see any effect of the 2025 interest rate falls, because there is a lag in the price regulation.

The other big component is called ‘retail’, which is payment to the companies, many of which are subsidiaries of the big energy companies, who buy electricity at fluctuating wholesale prices and sell it to consumers at fixed prices, generally with some time-of-day charging blocks. For this they take 16 cents in the dollar, 6 cents of which according to ACCC is profit, even though they have virtually no capital equipment. The ACCC reports that retailers’ costs and their profits haves increased significantly in the last two to three years.

This function, of smoothing out people’s charges, used to be done by the state-owned electricity utilities, without the hoopla of advertising, but in the name of ‘competition’ the job had to be handed over to the private sector. Just a few days ago Choice granted these money-leeching ‘retailers’ a Shonky Award. That award is well-earned by companies that have been able to rip off the public, who have been led by lying politicians to believe that renewable energy is responsible for high prices.

If the government had the gumption to admit that some privatisations were terrible economic mistakes, it would re-nationalise the electricity network and close down the retailers, leaving only the generation end to the private sector.

The second reason retail prices have not fallen is that the Australian Energy Regulator sets prices for what is known as the Default Market Offer — essentially a retail price cap — only once a year, to apply for twelve months from July 1. The government would be hoping that because wholesale prices are falling, and should continue to fall if more renewable energy and batteries can be brought on stream, next year’s Default Market Offer and the following year’s will be down on this year’s. Convenient in a pre-election period.

The third reason many people are not enjoying price reductions, covered at length in the ACCC report, is that they are not shopping around for the best bargains. The ACCC report reveals the benefits to consumers who shop around, and the costs to those who don’t. For example customers who are on flat rate offers that are two or more years old pay 17 per cent more than those on newer offers. The inference from the ACCC is that anyone who doesn’t shop around is a mug for allowing themselves to be charged a loyalty tax.

That makes sense in terms of the pure economic model of competition, but that model generally does not take transaction costs into account. Shopping around takes time, and requires a certain level of analytical capacity. It does not seem fair that those who lack time to shop around, or who are bamboozled by their electricity choices, should pay a premium for electricity, effectively subsidising retired engineers with spreadsheets.

In many markets there are benefits in shopping around. If the markets are sufficiently competitive those benefits are more likely to be in innovations, better quality and so on, rather than in price. But electricity is about as basic a commodity as we can imagine. We want it at 230 volts, 50 cycles, close to a power factor of 1. In fact, the ‘retailers’ have no option but to offer what’s in the wires, because they have nothing to do with the physical product.

It is reasonably straightforward to work out the government’s tactics on electricity prices. It has good reason to believe they have peaked in real terms, and should fall in future years, particularly in the years approaching what will probably be their next contestable election in 2031.

As for the National Party, its decision to abandon net zero seems to rest on the idea that ’everybody knows’ that renewable policies have driven up the price of electricity. To the extent that it has any logic, it rests on the post hoc ergo propter hoc fallacy, as stated by Senators Canavan and Cadell:

Since Australia committed to its net zero target, electricity and gas prices have increased by around 40 per cent.

That’s probably the best they can do to justify economic stupidity, but their policy stance has nothing to do with economics anyway. It’s a signal to climate deniers, anti-vaxxers, sovereign citizens, the chronically aggrieved, and others on the far right that the National Party is on their side.

Republished from Ian McCauley.com - Bear Weekly Round Up, 8 November , 2025

The views expressed in this article may or may not reflect those of Pearls and Irritations.