Our lopsided and unfair tax system

November 12, 2025

There is something weird and unfair in a tax system that requires young and productive workers to subsidise the lifestyle of the old and idle.

Robert Breunig of ANU’s Tax and Transfer Institute has a Conversation contribution: Taking from the young, giving to the old: how our tax system is letting us down. He confirms, with hard data taken from HILDA surveys, that “ we are taking money from people at an age where they need it most and giving it back to them when they appear to need it less” to use his words.

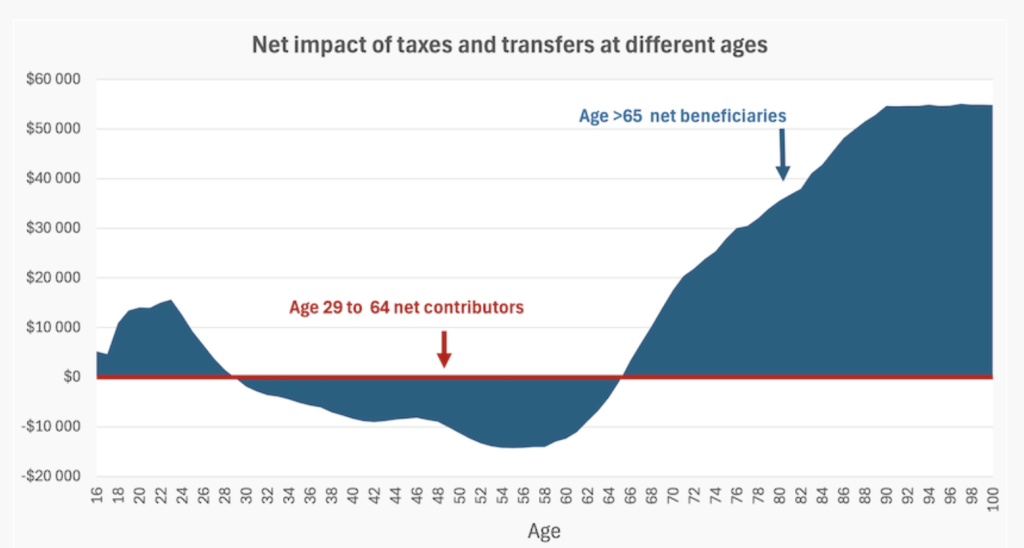

The graph below, taken from his data, shows the net impact of income taxes, consumption taxes, pensions and superannuation concessions by age.

More significantly, this inequity is widening. To quote one of his pieces of data, “the average 75-year-old’s post-tax and transfer income 25 years ago was little more than 75% of an average Australian income. Today it equals the average Australian income”. He also covers the inequities in access to housing.

A related Conversation contribution — five charts that show how young Australians are getting screwed — by Intifar Chowdhury of Flinders University covers more intergenerational injustices, including HECS/HELP debt, general cost-of-living stress, psychological distress and loneliness.

What does it take to get the young out on the streets to complain about their parents?

The views expressed in this article may or may not reflect those of Pearls and Irritations.