Western Australia is rich, but it's not the economic powerhouse it claims to be

November 26, 2025

Western Australian politicians claim the state is the “powerhouse” of the national economy and deserves an outsized share of GST revenue. The ABS State Accounts for 2024–25 tell a different story, revealing a decade of weak growth, falling per capita output and a system that rewards WA despite clear under-performance.

One of the mantras routinely chanted by Western Australian politicians in support of The Worst Public Policy Decision of the 21st Century Thus Far – the 2018 “deal” which gives Western Australia a bigger share of GST revenue than it needs in order to be able to provide its citizens with public services of a similar standard to the rest of Australia while levying on them a similar burden of state taxes and charges, at a cost to the Federal Budget of around $60 billion over the 11 years to 2029-30 – is that Western Australia is the “powerhouse” of the Australian economy, and that the state needs all this extra GST revenue in order to keep this powerhouse operating.

This mantra is also supported by federal politicians who want to curry favour with Western Australia (in order to retain or regain WA seats in the House of Representatives), as Federal Treasurer Jim Chalmers did most recently last week in an almost nauseatingly fawning speech to the Western Australian Chamber of Commerce and Industry in Perth.

The ABS State Accounts for 2024-25 expose this piece of propaganda to be a myth.

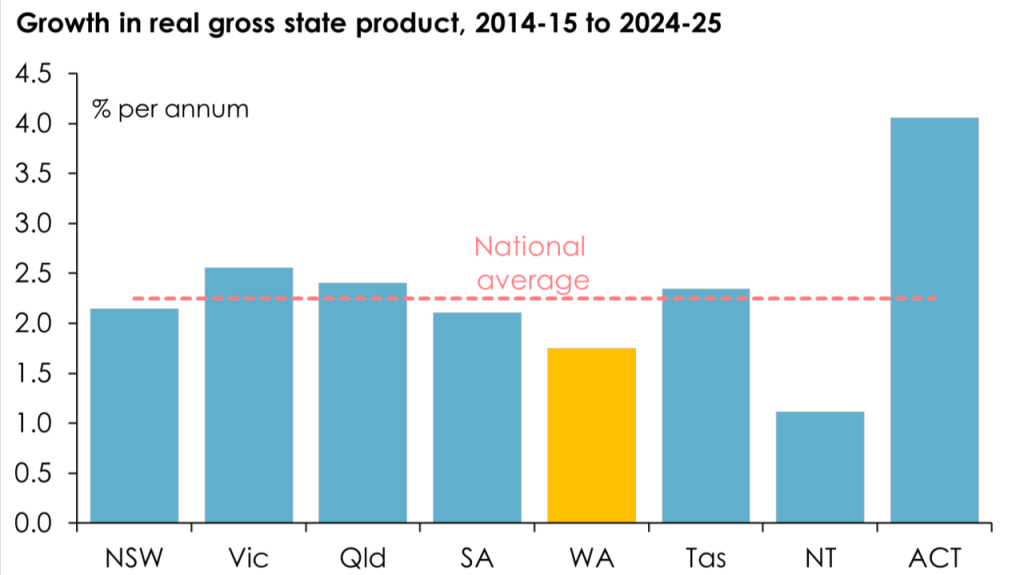

They show that, over the ten years to 2024-25, Western Australia’s real gross state product grew at an average annual rate of 1.7 per cent – the second-slowest of any state or territory (after the Northern Territory). Less than the national average of 2.2 per cent, and less than the states which Western Australians rejoice in depicting as ‘mendicant’, ie Victoria with 2.6 per cent per annum and Tasmania with 2.3 per cent per annum.

Western Australia thus accounted for 13.5 per cent of the growth in Australia’s economy over the past decade – less than its 17.1 per cent share of the size of the Australian economy over this period. Put differently, WA’s share of Australia’s total gross domestic product declined from 17.9 per cent in 2014-15 to 17.0 per cent in 2024-25.

Some powerhouse!

And lest any reader thinks I’m cherry-picking the 10 years to 2024-25 in order to cast WA’s economic performance in an unfavourable light, the same comparison holds if I pick, for example, the past five years rather than the past 10. Over the five years to 2024-25, WA’s real Gross State Product (GSP) grew at an average annual rate of 2.46 per cent: less than the national average of 2.51 per cent (albeit by a smaller margin than over the ten years to 2024-25), and less than the “mendicants” of Victoria (2.48 per cent) and Tasmania (2.61 per cent).

Moreover, Western Australia’s sub-par economic performance over the past decade has come despite having faster population growth than the rest of Australia – 1.8 per cent per annum, on average, compared with the national average of 1.5 per cent per annum.

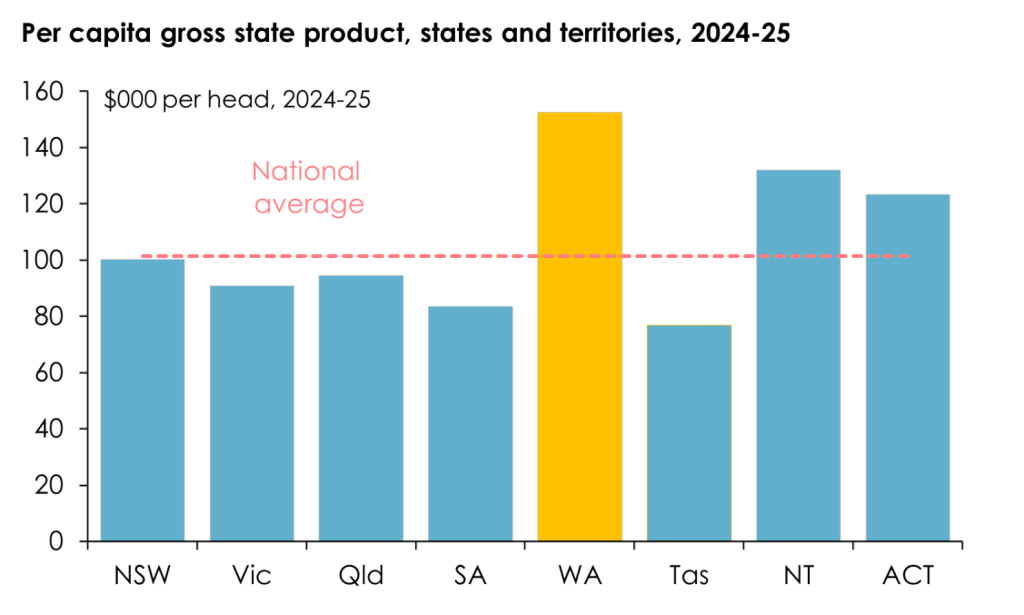

Which means that WA’s performance is even worse, relative to the rest of Australia, on a per capita basis. Probably the most astonishing figure to be derived from last week’s ABS State Accounts is that over then 10 years to 2024-25, Western Australia’s per capita real GSP growth has been …. zero. That’s the worst result for any state or territory. Even the Northern Territory did better, with real per capita GSP growth averaging 0.3 per cent per annum over the past decade - to say nothing of Victoria and Tasmania, whose per capita real GSPs grew at average annual rates of 0.9 per cent and 1.2 per cent over the past decade.

WA’s real per capita GSP has declined in each of the past two years (by 2.2 per cent and 1.1 per cent in 2023-24 and 2024-25, respectively), and in four of the past 10 years – a track record exceeded only by the Northern Territory.

Again, some powerhouse!

Despite this cellar-dwelling economic performance, as measured by real gross state product, Western Australia remains, as it has been for the past two decades, Australia’s richest state as measured by per capita gross product in nominal terms, with a per capita GSP of $152,502 in 2024-25, some 50 per cent above the national average (see chart below).

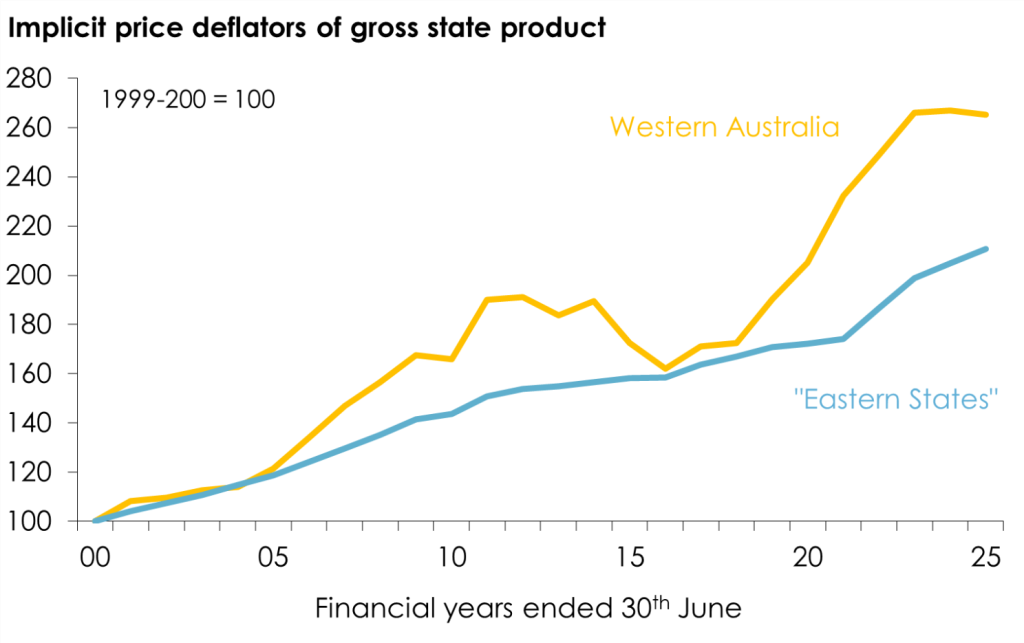

Western Australia hasn’t achieved this status through hard work or omniscient state government policies, as its politicians like to claim. Rather, it has come about entirely through rising prices for the commodities which nature (note, not previous WA Governments) has so richly endowed WA, as shown in the following chart:

Since the turn of the century, the prices of the things which WA produces have risen by 165 per cent – 55 per cent more than the prices of the things which are produced in the eastern states. That (and the fact that they possess things whose prices have risen by so much more than the things which the eastern states produce) is the sole source of the prosperity which Western Australians are now enjoying.

But they think the Commonwealth Grants Commission should ignore this, when determining how much each state and territory needs by way of shares of revenue from the Federal Government’s GST in order to be able to provide similar standards of services whilst levying a similar burden of state taxes and charges as the other states and territories – a principle to which successive WA State Governments took no exception prior to the early 2000s (when it worked in their favour).

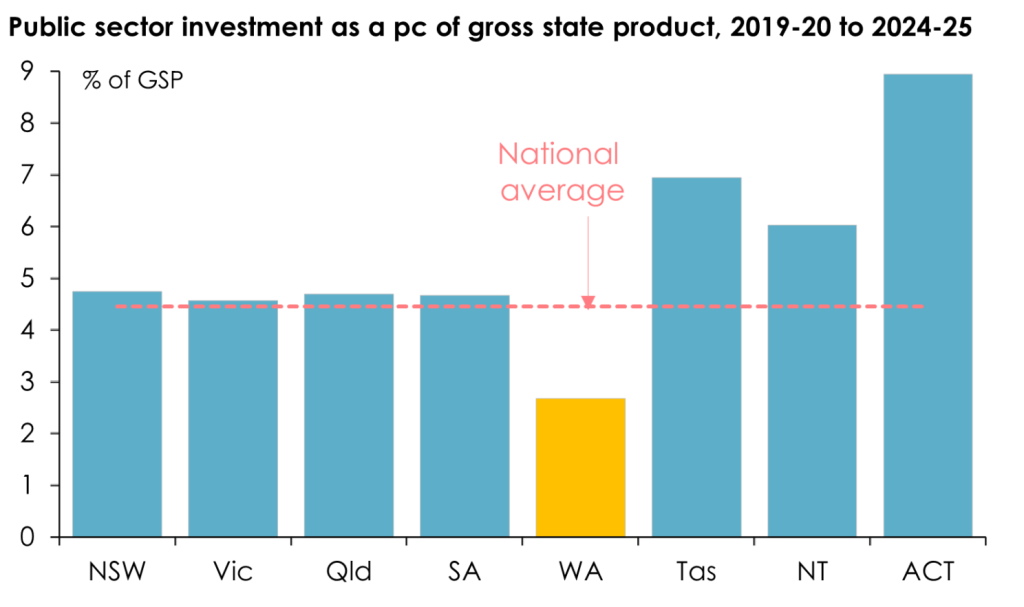

Last week’s ABS State Accounts also expose another myth routinely promulgated by the WA Government in defending The Worst Public Policy Decision of the 21st Century Thus Far – namely, that the WA State Government “needs” a bigger share of GST revenue than that to which it’s entitled, in order to fund the investment required to ensure that companies can keep digging stuff up in WA and selling it to the Chinese and others at very high prices.

The State Accounts show that public sector investment (including, the WA Treasurer Rita Saffioti should note since earlier this month she falsely accused me of not including it, investment by WA’s larger-than-average public enterprise sector) represents a smaller share of WA’s economy than that of any other state or territory:

The $6 billion more that WA is getting this year from the Federal Government’s GST revenue than it should be getting – which will rise to $7 billion more each year between 2027-28 and 2029-30 – isn’t going to fund investment in infrastructure required to keep mining and gas companies operating profitably.

Rather, it’s underwriting the budget surpluses that WA, uniquely in Australia and indeed highly uncommonly around the world, has been running since 2019-20 and expects to continue running until at least 2028-29 (totalling $25 billion) – and, ultimately, unless The Worst Public Policy Decision of the 21st Century Thus Far is reversed, will result in Western Australians (who, remember, live in a state which is richer than the rest of the country, by a bigger margin than any other state has ever been) getting better public services (schools, hospitals, policing, child protection, environmental protection, social housing etc) whilst paying lower state taxes and charges than other Australians.

Is that the sort of Australia that we really want?

And is pouring $60 billion of the Federal Government’s money over 11 years into an economy which has, over the past ten years, so clearly under-performed the rest of Australia really such a wise investment?

The views expressed in this article may or may not reflect those of Pearls and Irritations.

Please support Pearls and Irritations with your tax deductible donation

This year, Pearls and Irritations has again proven that independent media has never been more essential.

The integrity of our media matters - please support Pearls and Irritations

For the next month you can make a tax deductible donation through the Australian Cultural Fund