ABUL RIZVI: Morrisons budget plan was far riskier than Shorten's

May 20, 2019

Bill Shorten and the mainstream media failed to explain that Scott Morrisons alternative tax and budget plan was the far higher risk option. It requires record levels of population growth over the next ten years over 4.5 million more people. But how will this massive increase in population be delivered and when does Morrison intend to explain this to the Australian public?

The accepted wisdom is that Bill Shorten lost the 2019 election because he took a high risk tax and spend policy platform to the Australian people, with higher taxes particularly targeting older and more wealthy Australians.

But Morrisons alternative path, to which we are now committed, is far more risky.

With Shortens defeat, Australia has locked in highly concessionary arrangements for the taxation of capital income compared to the taxation of labour income something that had been designed largely by the Howard Government and hence Howards earnest defence of the arrangements.

With an ageing population, the cost to the budget of these highly concessionary arrangements for taxing capital income will grow and grow substantially something Shorten pointed out but not nearly as strongly as he should have.

As the population ages, the biggest challenges will be to maintain high rates of labour participation and employment whilst being able to pay for the health and welfare costs of older Australians. Taxing labour income at relatively high rates while providing highly concessionary tax arrangements for capital income is exactly what we should not be doing.

Scott Morrison would no doubt respond that income tax cuts he will now implement, including flattening the tax structure, will drive up participation and employment. But how can we afford to tax capital income at highly concessionary rates, pay for massive income tax cuts, particularly for higher income earners, and at the same time pay for an ageing population?

Having received large tax cuts, high income earners will then be in a position to take further advantage of the concessionary tax arrangements for capital income. That will impose further costs on the budget.

According to Morrisons 2019 Budget, this will be no problem at all. The 2019 Budget shows surpluses as far as the eye can see (or at least for the next 10 years). It also shows us paying off net debt over that period. No doubt everyone now believes we will all be in clover after that!

A key to these surpluses is that over the next ten years, Morrison forecasts creation of another 2.5 million jobs - that is 250,000 jobs per annum. That would certainly help to increase both tax revenue and increase household consumption.

But such massive employment growth can only be achieved if we have a commensurately high rate of population growth.

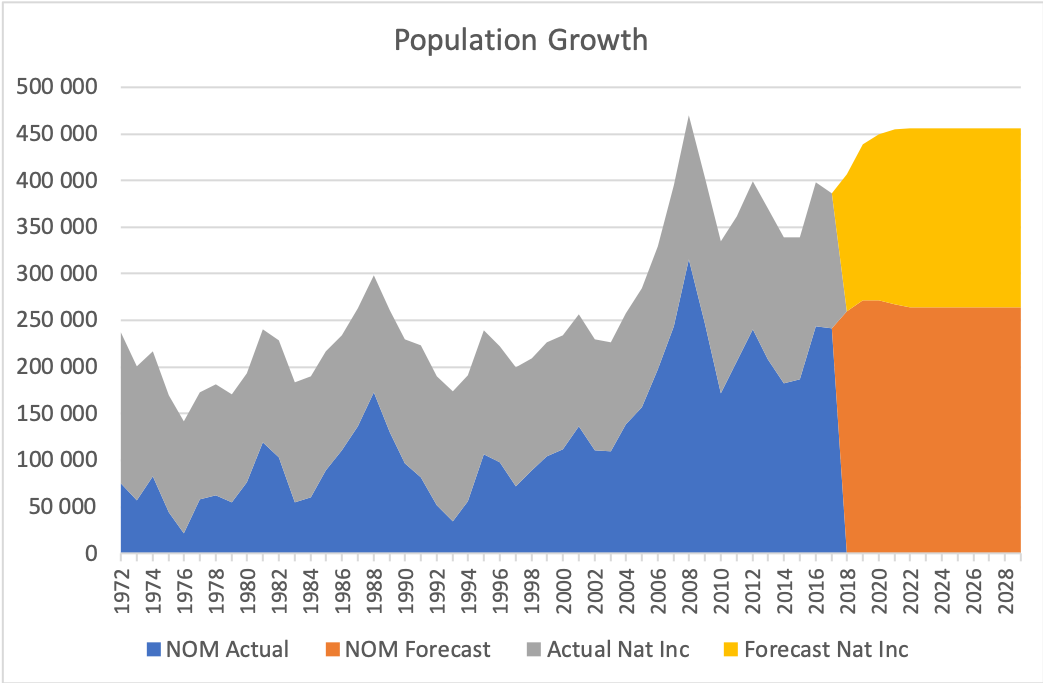

And indeed that is what the 2019 Budget assumes. Over the next ten years, our population is forecast to grow by over 4.5 million people or around 450,000 per annum with over 260,000 per annum, or 2.6 million over ten years, coming from net overseas migration (NOM). Compared to the 2018 Budget forecasts, NOM is assumed to be 155,000 higher over four years and over 400,000 higher over ten years (see Chart 1).

Leaving aside Morrisons faux congestion busting rhetoric - the bulk of the population increase he is forecasting will occur in the major capital cities - as well as the bizarre idea that Australias fertility rate will increase to 1.9 babies per woman by 2021, the big question is whether we can sensibly achieve the highest sustained rate of net overseas migration (NOM) over any ten year period in our history. And all the while busting congestion by sending a few of these people to the bush.

Having cut the permanent migration program by 30,000 per annum, the forecast increase in NOM has to be through even stronger growth in temporary entrants. The stock of temporary entrants would need to grow from the current 2.3 million to over 4 million in ten years.

This raises some serious questions.

Firstly, NOM is highly sensitive to economic and employment conditions. Chart 1 highlights how rapidly NOM has in the past fallen with each major economic slowdown. If the economy slows in 2019-20 as the Reserve Bank is forecasting, NOM will fall well below the levels Morrison needs to achieve his employment growth targets and budget surpluses. If the slowdown persists, his plan would be in tatters, leaving Australia struggling to meet the costs of its ageing population, the costs of the generous tax concessions for the capital income earned by well off older Australians as well as his income tax cuts to achieve a flatter tax structure.

Secondly, by making pathways to permanent residence for temporary entrants more difficult, Australias ability to attract high performing skilled temporary entrants and overseas students will be negatively impacted. Education providers will need to further lower standards to recruit the number of overseas students required and Australian employers will need to use salary, skill and English language concessions to recruit larger numbers of temporary workers. These workers will tend to be in lower skill positions.

Thirdly, the Government will also be relying on expanding the higher immigration risk Work and Holiday worker visa as well as the new temporary parent visa. The latter will have a negative impact on participation and employment rates.

Finally, it is hard to believe, but record numbers of non-genuine asylum seekers arriving in recent years as well as the massive backlogs at the AAT may also be included in the Governments forecast for higher levels of NOM.

If the Government does achieve its NOM forecasts, we can also expect increasingly more frequent reports of temporary entrants being exploited.

Let no one be fooled, Morrisons budget plan is seriously high risk its magic pudding stuff - and assumes an extraordinary level of population growth that he is yet to explain to the Australian public.

AbulRizvi was a senior official in the Department of Immigration from the early 1990s to 2007 when he left as Deputy Secretary. He was awarded the Public Service Medal and the Centenary Medal for services to development and implementation of immigration policy, including in particular the reshaping of Australias intake to focus on skilled migration. He is currently doing a PhD on Australias immigration policies.