Chinas worrying economic policy drift

February 8, 2024

The Rhodium Group, an independent research organisation with a focus on China, says the nations economic policymaking process has stalled with it refusing to announce meaningful actions to overcome its pressing property and share market crashes let alone forge a clear path for the future. The full paper can be accessed here.

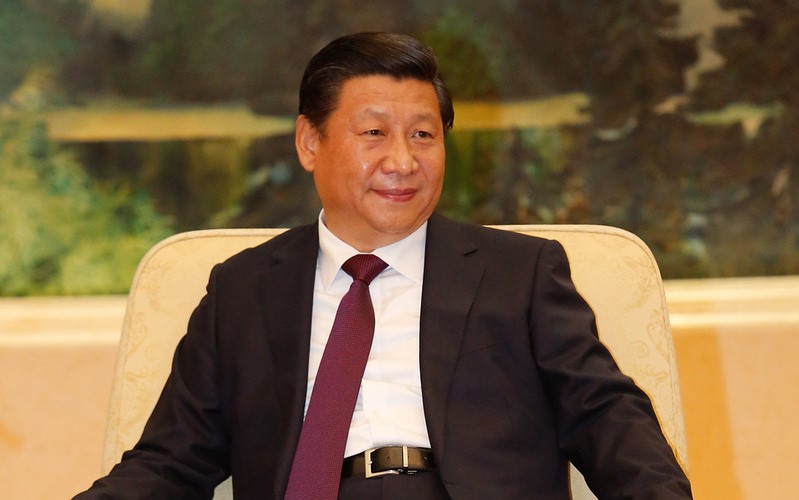

Here is my understanding of what has happened to economic policy under President Xi Jinping.

Good diagnosis, yet inadequate solutions

Xi correctly identified the key problems that emerged from the late President Deng’s policy of unbridled capitalism, namely corruption of government officials, debt fuelled property development, local government dependence on land sales, over reliance on foreign trade and widening income and wealth disparity.

But his remedies for these problems were largely ham-fisted, perhaps because he had no training in economics and as a communist ideologue prefers blunt controls to deep institutional and policy reform.

Corruption

He attacked corruption with high profile arrests rather than establishing a transparent style ICAC (Independent Commission Against Corruption), which aroused suspicion he was targeting enemies not fighting crime. However, Transparency Internationals corruption perceptions score for China did fall from an all-time peak of 100 in 2014 to 76 by 2023 though this was higher than the two previous years suggesting progress may have stalled. See chart below.

Corruption Perceptions Index reported by Transparency International.

Source: China Corruption Rank (tradingeconomics.com)

Companies

He also installed communist cadres in many companies to ensure their compliance with party principles which was criticised for detracting from their commercial focus. He also strengthened anti-trust legislation to prohibit monopolies, price fixing, bid rigging, market dominance and anti-competitive mergers which was welcome.

He ended debt fuelled property development by ordering banks to stop lending to developers who then went broke because they were undercapitalised. Evergrande is just the tip of the melting iceberg. Instead, he could have given developers a time limit to accumulate sufficient working capital to reduce their debt-to-equity ratios to a safe level. Banks may now resume lending to developers but only for repaying loans and staying afloat not for new construction.

Xi has not come to the aid of local government which is struggling to provide basic services because its main source of revenue (subdividing and selling public land to private developers) dried up.He should reform China’s tax system to give a bigger share to local government, so it does not have to survive on land sales.

Equity

Xi tried to tackle rising inequality by appealing to entrepreneurs to donate more to charities.This had a muted response because businesses are still struggling to overcome losses incurred during long Covid lockdowns. Moreover, philanthropy is not an adequate substitute for reforming the country’s progressive personal tax system by closing its loopholes and strictly enforcing collections.

To promote equity, Xi banned private educational tutoring to stop wealthier parents giving their children an advantage in school exams. The result was lower grades overall. He has largely eradicated poverty by increasing the minimum subsistence allowance but is reluctant to boost welfare payments more generally lest it discourages work effort.

The collapse of property and share prices has left China’s consumers shocked because home ownership is high and holding shares for retirement is becoming more common given inadequate access to social and medical security for many workers and self-employed outside government.

Remedies

Xi has refused to use public borrowings to bail out developers, home buyers and local government because of themoral hazard risk and to avoid the debt trap of western governments. But he may have no choice if these problems keep mounting.

Also, it is imperative he shift China from investment and export driven growth to domestic consumer led growth to escape the “middle income trap” of most developing economies and to become less dependent on western markets.

To do so he needs to offer better social and health security, so households spend a larger proportion of their incomes rather than saving for old age and medical emergencies. That requires reforming the tax system to raise more public revenues. Also privatising inefficient state-owned enterprises instead of subsidising them would free up public resources for social rather than commercial ends.

His Technology 2025 plan to digitise industry and focus on EVs, green energy, 5G networks, AI, robotics, and advanced semi-conductors is smart, but his crack down on hi-tech entrepreneurs (whose social media profiles generated Trump like cult followings) has cowered them. Also restricting access to information about companies and clamping down on market research has scared off foreign investors.

The Wests boycott of Chinese technology on security grounds is hampering China’s efforts to further lift its living standards. Also, American trade sanctions have prompted both foreign and Chinese factories to relocate overseas (especially to Vietnam and Mexico).Xi is keen to stabilise relations with the US, but both Biden and Trump compete on who can be tougher on Chinese trade, investment, and technology (e.g., high end chips).

Conclusion

I believe Xi means well with his anti-corruption, debt reduction, self-sufficiency, and common prosperity goals. But as the Rhodium Group found, China lacks both an up-to-date economic restructuring plan as well as bold fiscal and monetary measures to overcome its most pressing problems, the collapse of Chinas property and share markets. This is causing deflation and depressing consumer confidence which has not recovered from its Zero Covid lockdown lows. Households still prefer precautionary saving to carefree spending. See chart below.

As Chinas “Helmsman”, will Xi take expert advice and act decisively to jump start Chinas faltering economy and to fundamentally restructure it for the long run? We should know in coming months. Hopefully, he is up to the task, otherwise his Politburo colleagues could eventually tap him on the shoulder.