Environment: Fossil fuel company profits are delaying grid decarbonisation

March 30, 2024

Securing a liveable planet and the retail price of electricity are important but current fossil fuel profit margins are slowing grid decarbonisation. Water temperature in the Pacific is influencing methane emissions in the sub-Arctic. Enjoy nature this Easter.

Washingtons cherry blossom peak bloom

Whoever is the next President of the USA will have fewer cherry trees to admire in full bloom in the Washington DC spring of 2025. The trees were given to the USA by Japan over a hundred years ago and enjoying the cherry blossom season has become a highlight for locals. But climate change is having its effects.

First, global warming is causing peak bloom (when 70% of the trees are flowering) to occur earlier than previously. This year it happened on March 17th, the second earliest day on record and more than two weeks before the long-term average.

Second, sea level rise is causing problems for the sea wall around Washingtons Tidal Basin and flooding of the area is damaging the trees. Repair of the sea wall will necessitate removal of 158 of the cherry trees, including Stumpy, a crowd favourite.

Profit not price controls the energy transition

In The Price is Wrong: Why Capitalism Wont Save the Planet, Brett Christophers, a human geographer, argues that cheap electricity from solar and wind will not drive the energy revolution needed to end the fossil fuel era. Profits are more important than being green and cheap. The following are extracts from an interview with Christophers that appeared in the Bloomberg Green newsletter on 25 March 2024.

Bloomberg Green: Why is it important to focus on profits instead of costs when we talk about decarbonizing the grid?

Brett Christophers:Theres this widespread argumentthat theeconomics of renewables work and that the only remaining significant obstaclesare political andin the planning realm around permissions. The book pushes back quite forcefully against that argument and suggests that thats a very partial and misleading perspective on the economics of the transition.

The basic argumentis simpleand its something that the worlddoesnt want to admit: The business of developing and owning and operating solar and wind farms and selling the electricityis kind of a shitty business. Its really not a very attractive business. Its a very competitive business where returns are not justlow, but volatile and difficult to predict. All of that has a chilling effect on investment in thatsector.

Whether new solar or wind farms get builtis ultimately about the expected profitability of those assets. Even though the generating cost aspecthas become increasingly beneficial over timethat doesnt necessarily mean that the expected profits are gonna be there.

BG: Whats different about profits for renewables versus fossil fuel generation?

BC: Generating costs are only part of the costs thata company that owns and controls a solar or wind farm and sells the electricity incur. There are also costs associated with delivering that power to where it gets consumed.

For renewables the delivery costs tend to be higher than they are for conventional power plants because conventional power plants on averagetend to be located closer to centers of demand. Thats because unlike conventional power plants, renewables likesolar and wind farms require huge amounts of land to produce significant amounts of power.

Unless governments are willing to either assume the burden of renewables developmentthrough public ownership, public financing or essentially compel private firms to build renewables like they do in wartime they will have to keep subsidies and tax credits in place indefinitely or else renewables investment will collapse because of the unfavorable economics. The Inflation Reduction Actis a testimony to that.

BG: Fossil fuel companies make big profits because they dont pay a carbon price. So isnt the case you’re making that renewables aren’t profitable really a case for a carbon tax on fossil fuels?

BC: In partit absolutely is an argument for larger carbon taxes on fossil fuels. When a company that is considering a development in wind and solar considers making that investment sometimes its a fossil fuel company like a BP that is comparing it with the returns available in fossil fuels. But mostof the time itsa company whose business is renewables development, and the question is not fossil fuelsor wind farm. Its wind farm or no wind farm.

Yes, for part of the market that carbon taxes argument comes into the equation. But for part of the market, it comes down to buildinga wind farm, leavingthe money in the bank or putting it in treasuries.

Tim Buckley rubbishes Woodsides nothing burger on clean energy

Taking a somewhat different and distinctly Australian perspective on the same issue, Tim Buckley has applied the blowtorch to Woodside and its CEO Meg ONeill and Chairman Richard Goyder (recently retired Chairman of Qantas).

Regarding Woodsides recent decision to delay its green investments, Buckley accuses them of corporate climate denialism and dereliction of fiduciary duty to invest strategically for the long-term interests of shareholders. In response to ONeills claim that Woodsides commitment to dig and ship more climate-destroying fossil fuels will deliver a shareholder bonanza, he points out that the Woodsides shares have been sliding for the last ten years, underperforming comparing with the Australian share market by 50% - a dog of an investment for a decade, he insists.

Buckley applauds the decision of superfund HESTA, a significant shareholder, to call this climate laggard to account and implicitly encourages other corporate investors to vote against the reappointment of Goyder so that Woodside can develop a meaningful climate action plan. If that is beyond the capabilities of Woodsides failed leadership, it should harvest the profits from existing projects and pay good dividends to shareholders so that they can reap the benefits from reallocating their capital to firms that act in alignment with a liveable planet.

Vicious cycle of global warming and wetland methane emissions

You might think that Im pushing the friendship somewhat if I suggest that the water temperature at Bondi influences the amount of methane released from the boreal forests and tundra across Canada, Greenland, Iceland, Scandinavia and Russia. But stay with me.

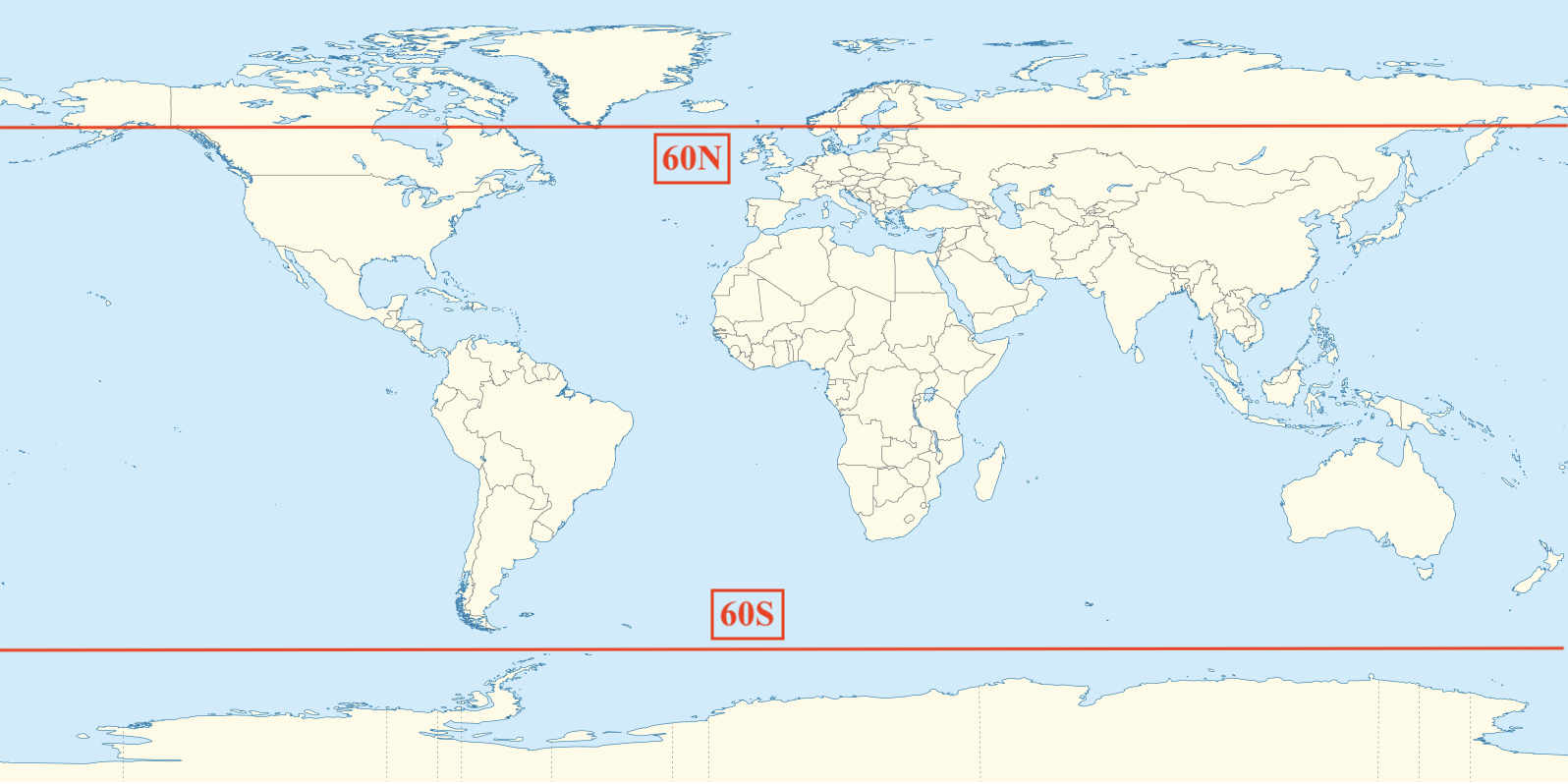

First, three facts to help the explanation along. (1) Methane is the second most important greenhouse gas and in the short term has a much stronger effect on global warming than CO2. (2) Wetlands are the largest natural source of methane, particularly those in the boreal and tundra regions of the northern hemisphere (most of the land on the polar side of 60oN). (3) The Arctic is warming 3-4 times faster than the global average, producing a warmer, wetter and greener Arctic.

Despite year to year variations, between 2002 and 2021 annual methane emissions from the wetlands of the boreal forests and tundra (which occur mostly in summer) showed a clear increasing trend (9% over the 20 years). About 52% of the trend was attributable to temperature increase and 41% to variations in the Gross Primary Productivity of the ecosystems (more vegetation produces more organic matter in the soil for microbes to turn into methane).

The largest methane emissions occurred when there was a strong El Nino event (particularly in 2016), highlighting the role of the El Nino-Southern Oscillation (ENSO) cycle on moisture and weather patterns globally. Hence the importance of the Bondi water temperature in essence, the knee bones connected to the thigh bone, the thigh bones connect to the , etc., as the old song says (YouTube video for younger readers the comments are worth reading as well).

More importantly for climate change, theres a positive or reinforcing feedback loop operating here: methane causes global warming, global warming increases the emission of methane in the far north, more methane emissions cause more global warming. On top of which, it seems that current global warming models are not adequately taking these issues into account.

For a less climate damaging diet, eat less beef

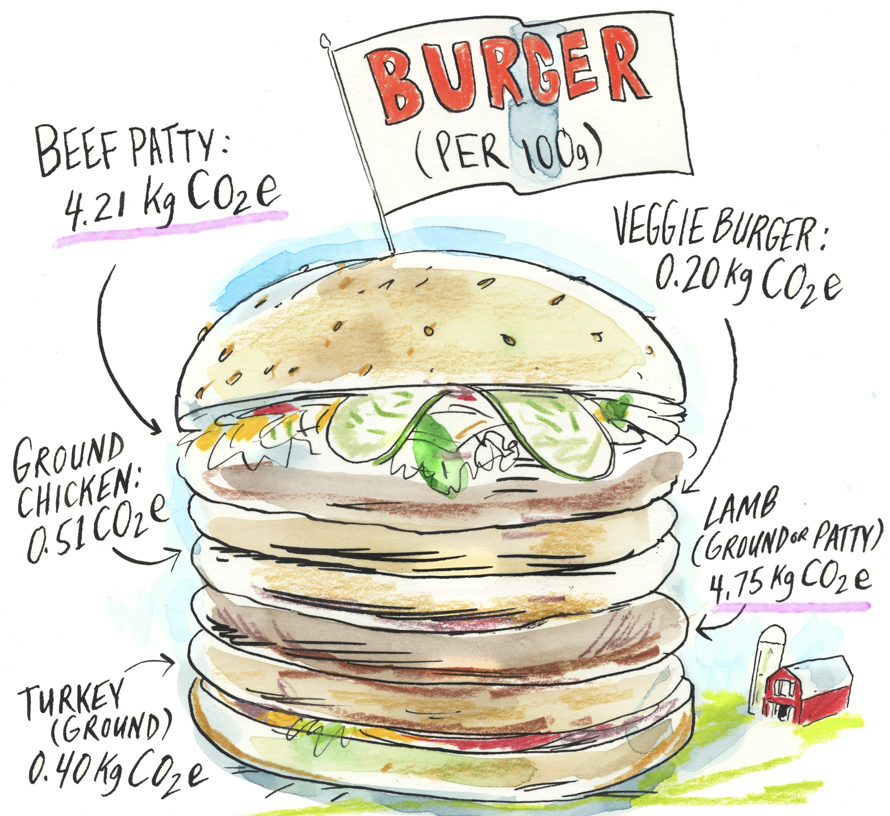

Want to make just one change to your diet to reduce your greenhouse gas (GHG) footprint? Replace beef (whether it be a juicy steak, an aromatic roast, a beefburger or a hotdog) with another protein (lamb isnt the best choice) in just one meal and youll halve your emissions for the day.

Beefs GHG footprint doesnt come only from eructations (special Easter word for burps). It also arises from the land cleared to grow feed and for cattle to graze on, and from the fertilizer required. A quarter of all agricultural land is used to feed and raise cattle.

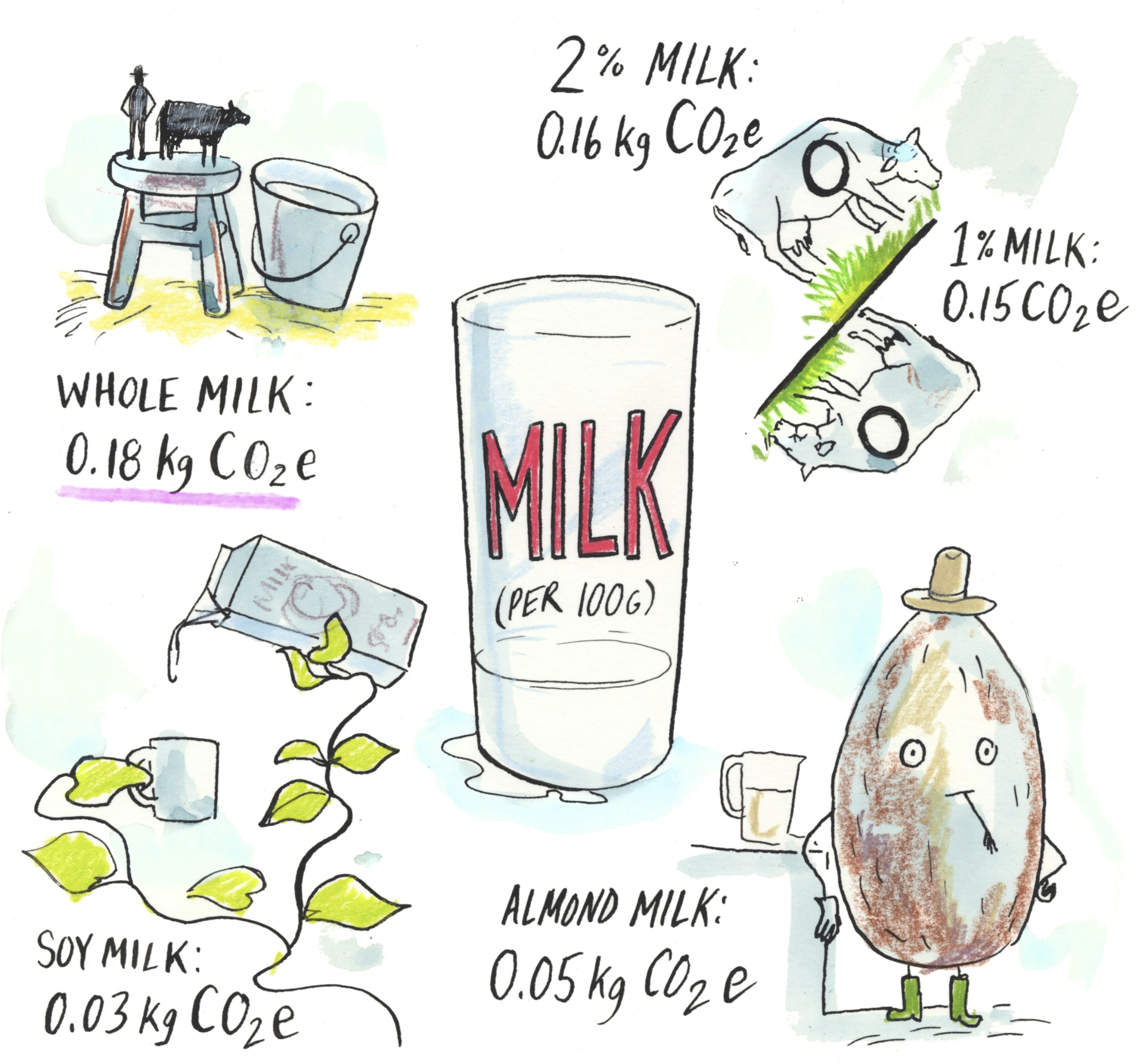

If you want to go one step further to reduce your emissions (your GHGs that is, not your eructations), replace cows milk with soy, oat or almond milk, although the production of almond milk requires a lot of water.

Magic Moments

Ive had three delightful moments in the natural environment this week. On Monday morning I came across an Australian fur seal* relaxing and feeding among the kelp (which wasnt there a few years ago) at the entrance to Rushcutters Bay in Sydney Harbour. On Tuesday morning I shared a glorious sunrise with a crowd of noisy cockies at Echo Point, Katoomba in the Blue Mountains and then recorded a lyrebird, not seen despite being very close, going through its repertoire of songs and imitations. And on Wednesday morning I almost trampled on a pair of Superb Lyrebirds on a track less than two kilometres from Echo Point.

(* Just to remind you, seals move on land by belly wriggling and have external ear flaps, while sea lions walk on their flippers and have visible ear flaps.)

Try to spend some time in nature this long weekend.