Banking business as usual

July 15, 2020

If the banks make concessions to borrowers deprived of income due to the pandemic it will be their first socially considerate act since financial deregulation.

The paucity of significant media coverage since the completion of the Hayne banking Royal Commission has given the banking sector freedom to carry on as usual.

True, some senior executives and board members were forced to resign. Some banks have, desirably, sold off their wealth management divisions. Some banks have been forced to compensate victims of poor (or no) financial advice. Westpac is facing court over its money laundering indifference.

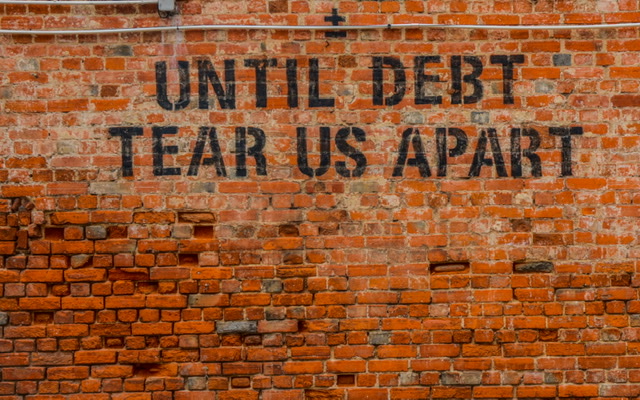

However, regarding the credit relation, at bankings core, change is indiscernible. The Hayne Commission consigned it to the margins. The structured power imbalance between lender and borrower remains in place.

There was much ballyhoo post-Hayne regarding institutional transformations. The Financial Ombudsman Service was folded into the new Australian Financial Complaints Authority, accompanied by huge PR. Heads rolled at ASIC, and the revamped body promised significant action. Fines for white collar crime were increased dramatically. And so on.

Since then what? The acid test is what has happened regarding legacy cases of small business and family farmer borrowers and ill-fated mortgagors who fell victim to incompetence and predation over 35 years since deregulation. Effectively nothing of substance. A small handful of victims have been given a settlement whether sufficient is another matter.

The banks have created customer advocate/relations departments, a phenomenon noted by CHOICE in June 2018. An important development in principle. They claim themselves to be independent, but I dont think so. No doubt some easier customer complaints are resolved in the customers favour, but the harder ones? I am privy only to the harder ones, hence a biased sample, but their experiences are crucial to understanding the state of play.

Westpac, representative, is playing hard ball (vide my recent The Sins of Westpac).

The CBA has buried its many hundreds of Bankwest commercial property victims, surely one of the largest individual scams in Australian banking history, without effective opposition. Shockingly, this crime had the blessing of the Hayne Commission itself. David Cohen, a key player in and sole public defender of this takedown, remains in a key managerial position at was what once the Peoples Bank.

A not unrepresentative single case: Tasmanian Suzi Burges small business retail operation and property investment was destroyed over 2008-13 by CBAs combined incompetence, predatory lending, predatory default and wilful sale of Burges assets (including the family home) under value. A cabal of legals (overseeing a gun-to-the-head unconscionable deed of settlement) and the courts enforced the crime. CBAs customer relations personnel have acknowledged CBAs failures, but compensation appears to have been lost in the mail.

The NAB hired Jeff Kennett as a mediator for several dozen hard cases, for which he proved unfitted for the job. Of these, the bank recently made a settlement with a widow, her deceased husband being the entrepreneur of a significant regional family business that was strategically destroyed by the NAB to favour a big business competitor with which the NAB had directors in common. The couple were deprived of hard-won tens of millions of dollars of assets. The customer advocate personnel had a set agenda, dictated by Head Office because of the cases significance. The bank, of course, denied responsibility for the heinous crime, but offered the settlement because it felt sorry for her. In short, customer advocate/relations departments merely waste large-scale victims time.

It appears that the much-heralded AFCA is no better than FOS. A recent AFR article on AFCAs treatment of legacy cases has the organisation praising itself for its working through the cases. $15 million has been obtained from the banks for customers. But with a claimed 55% of cases processed of 1886 legacy complaints before the special twelve months dispensation was closed off, that makes $15,000 on average per compensated customer. Miniscule. By all means cater to the dudded small fish, but the rest?

The claimed poor response rate to the legacy case dispensation may be due to trauma on the part of the victims, to disgust with their treatment by FOS, or to the victims conditions falling outside AFCAs limits (see Excluding complaints). AFCA limits have been extended from FOS, but they are still prohibitive for small business complainants where multi-millions are at stake.

I emailed Chief Ombudsman David Locke in April 2019. I pointed out that AFCAs raison dtre was not as mediator between squabbling parties but as vehicle to redress the structured imbalance of power between bank and customer. AFCAs bailiwick is crime scenes. Locke has been confronted up close with the ravages of bank malpractice (not least Burge), but this awareness hasnt resulted in appropriate AFCA action to date.

ASIC acquired responsibility for business to business unconscionability in financial services in a 2001 amendment to its Act, operative March 2002, embodied in s12CB & s12CC (copied from the then s51AC of the Trade Practices Act). To my knowledge, ASIC has not taken a single case under these sections regarding business borrower victims re bank malpractice. It lies to complainants and tells them to buggar off.

I wrote to ASIC Chairman Lucy in May 2004 regarding this matter (buggar off). Ditto to Lucys successor DAloisio in December 2010 (buggar off). Ditto to his successor Medcraft in June 2011 (buggar off). Ditto to his successor Shipton in March 2019 (no acknowledgement). ASICs considered neglect of its legislated responsibilities constitutes knowing complicity with bank malpractice.

More, ASIC, formally responsible for FOS/AFCA, has evidently no interest in the latters effectiveness.

APRA considers that its sole role is the stability of the financial system. Bank malpractice threatens system stability. Ergo, it is not in APRA personnels interests to care about bank malpractice, though they are well familiar with its manifestations. Dont bother us.

There have been amendments to various Acts, not least the Corporations Act, that ups the penalties for white collar crime. But the gargantuan Corporations Act appears to be irrelevant to the problem (save for receiver/liquidator iniquities, but that mob also remain immune). More, whatever legislation is applicable is unlikely to be invoked. How many bank senior executives have been indicted for crimes which they oversaw if not initiated? The big zero.

Beyond unconscionability (a civil matter), bank fraud (criminal) remains untouchable. Victims have to go to the local cop shop, which doesnt have the wherewithal. Should there be a rare local police force who intuit the problem, they are likely to be sat on from higher up the hierarchy. Meanwhile, the AFP has no unit dedicated to financial crime but devotes its considerable resources to politicised witch-hunts.

Save for rare exceptions, the courts are not a good look for bank victims. The problem goes beyond the prohibitive expense to an entrenched bias towards bank lender against bank borrowers. That dimension requires lengthy treatment on another occasion.

Finally, the political class is a dead loss. The ghost of Democrat Senator Paul McLean, sometime champion of bank victims and crucified for his pains, looms large. Since 1991 and the whitewash Martin Report, only the odd backbencher has taken seriously victim constituent complaints, then to be ignored.

Politicians have the opportunity to grandstand at Parliamentary hearings and inquiries that confront bank malpractice head on, but nothing of substance comes of these perennial and resource-consuming proceedings.

Clare ONeil, briefly Shadow Minister for Financial Services, oversaw the ALP cross-country interviews of bank victims and the subsequent excellent ALP submission to the Hayne Commission on behalf of victims of bank misconduct. This role evidenced a rare commitment and understanding of the problem. For her pains, she was omitted from this key shadow ministry after the March 2019 federal election. What was Labor thinking?

The Hayne Commission has come and gone and it is banking business as usual.