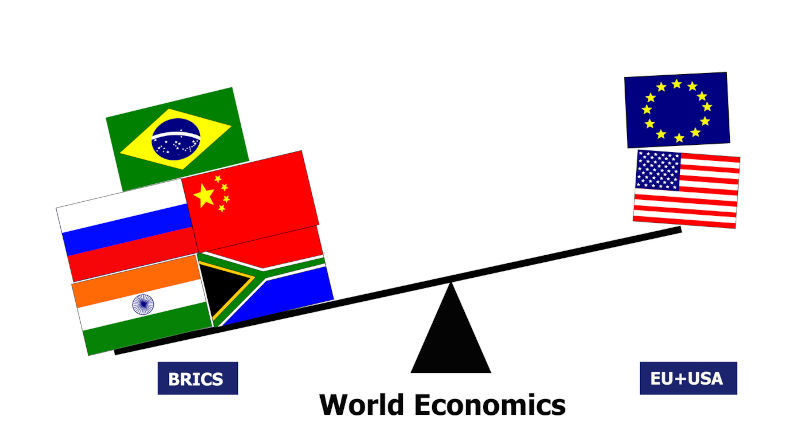

Expanded Brics will continue to chip away at US dollars dominance

September 4, 2023

How the US has used its dollar privilege for its own interests, without regard to the damage it causes others, has not gone down well with developing countries. The BRICS formation and expansion must be seen for what it is: a rallying cry for a fairer world order.

In January next year, six more countries Saudi Arabia, UAE, Iran, Egypt, Ethiopia, and Argentina will formally join the Brics grouping that currently encompasses Brazil, Russia, India, China and South Africa. Its membership will continue to grow as many more countries have expressed interest in joining, and the current expansion was described as the first phase with further phases to follow.

Western reporting on Brics have been biased and grudging. Before the Brics summit in South Africa, major Western media outlets reported that India and Brazil were against enlargement.

While the pre-summit narrative was internal dissension, the post-summit summation questioned what the expanded group could really do, and that consensus would remain difficult.

Commentators seemed to disapprove of Russia and China but thought better of India and Brazil because the latter two are seen as West-leaning. Some saw Brics as a manifestation of resentment of Western global leadership. The more facetious suggested the bigger Brics would need to change its name and the new acronym would be unpronounceable gobbledegook.

The fact is that Brics has gained status and influence. Critics dont bother to point out the summit in South Africa was the 15th gathering. Members have been working since 2009 to explore how they could cooperate on development.

Why? Because the global political and economic governance system referred to as the rules-based international order by Western countries ignores the interests of emerging economies.

This became obvious in 2008. The US financial and regulatory system lost credibility in the eyes of the world because of its failure to regulate unscrupulous investment banking practices that fuelled a housing bubble in the US. This eventually resulted in a global financial crisis that dampened investment around the world and reduced imports from developing economies.

Poorer economies had balance of payments difficulties because they lacked sufficient foreign exchange reserves, mainly US dollars. They needed assistance at reasonable terms from the Washington-based World Bank and International Monetary Fund, both being parts of the financial architecture of the ruled-based international order.

Developing countries called upon these institutions to take their circumstances into account but were ignored.

Fed up, Brics established its owndevelopment bankin 2015 and entered into a contingent reserve agreement, which is a currency swap mechanism to provide short-term liquidity to combat balance of payment problems. In other words, they created an alternative to the World Bank and the IMF, without challenging them directly.

Brics raison dtre needs to be better appreciated. South African President Cyril Ramaphosa said, An expanded Brics will represent a diverse group of nations which share a common desire to have a more balanced world order. Members of Brics, particularly Saudi Arabia and the UAE, will add substantial investment capabilities to the group. In considering enlargement, there must have been negotiations about arrangements that benefit members, such as increasing use of theirown currenciesto pay for trade.

The dominance of the US dollar in international trade and as reserve currency puts pressure on developing economies, as was evident during the 2008 financial crisis.

Moreover, the piling on of trade and investmentsanctionsand thefreezingof US dollar deposits of countries that Washington sees as against its interests have changed the mindset of many countries. The US dollar can a source of risk, whereas it used to be seen as an assurance of stability.

Joe Biden set to unveil substantial new G7-backed sanctions aimed at Russias war in Ukraine

Its hard to blame much-sanctioned Russia and much-criticised China for trading with each other using therouble and renminbi. What may be irksome for the West was Indian petroleum refiners settling some payments for Russian oil in yuan, but that was just the first blow.

Argentina used yuan from aswap line with Chinato complete a payment to the IMF in June, and India bought a shipment of oil from the UAE just days ahead of the Brics summit in rupees. Its hard to think there was no orchestration among the countries.

The theme of the summit in South Africa contains a clear message for the West: Brics sees itself as a champion of the needs and concerns of the peoples of the Global South and wants partnership for mutually accelerated growth, sustainable development, and inclusive multilateralism.

From the summits final statements, it is clear what is in the pipeline. Brics members will continue to strengthen their financial architecture to ensure stability and expand the use of local currencies for trade.

Although the US dollar willstill dominateglobal trade and as reserve currency, the chipping away of its influence resulted from itsfailure to recognisethat privilege comes with responsibility. The US desire to inflict pain on its opponents blinds it to the plight of others.

Countries on the receiving end of the ire of the US and those that become collateral damage dont think it is fair that the mighty throw their weight around without consequences.

No one wants a fight but Brics rallying cry to build a world that is fair, a world that is just, a world that is also inclusive and prosperous is attractive to many countries that need to be lifted by those who are ahead.

An expanding Brics may be what the world needs now. Forget fighting and focus on development and cooperation despite differences.

First published in the South China Morning Post August 30, 2023