ISABELLE LANE. Six big players dominate Australias scandal-hit aged care sector (The New Daily, 19.09.18)

September 19, 2018

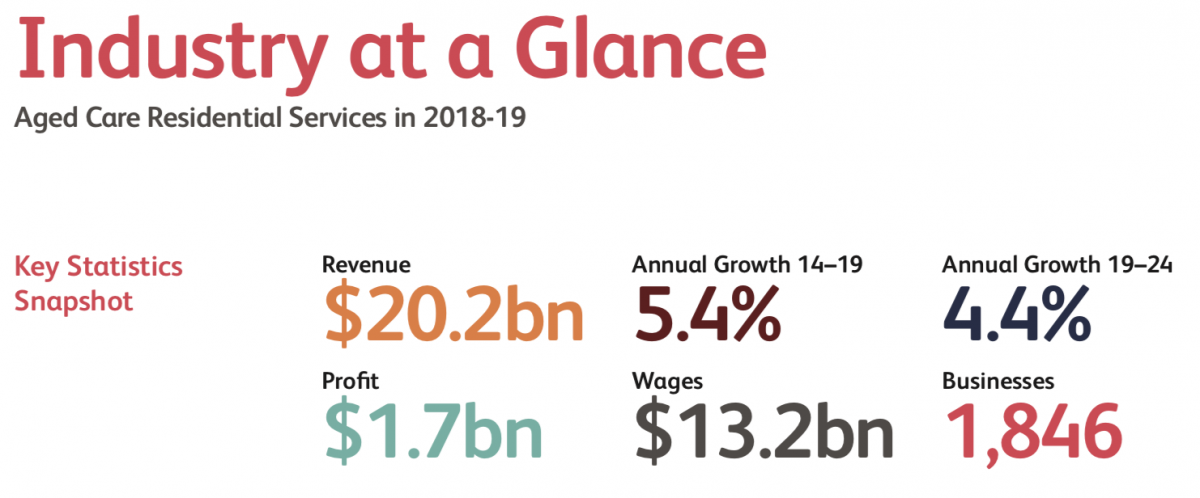

Agedcare providersare expected torake in$1.7 billion worth of profits in 2018-19,butreports of poor living conditionsinnursing homeshave raised concerns that the industry is putting profitbeforepeople.

So who arethe corporate giants running Australias nursing homes, and how much are they making?

Australias residential aged care industryis made up of 902 companies that provide200,689 residential places.

The industrys major playersincludesix big for-profit companies:Bupa, Opal, Allity, Regis, Estia and Japara.

According toareport by IBISWorld, aged care providerswillmake $1.7 billion in profitsover the current 2018-19 financial year.

Aged care services providers are forecast to earn $1.7 billion in profits in 2018-19. Source: IBISWorld (July 2018)

Industry revenue is expected to grow at an annualised 5.4 per cent over the five years through 2018-19, to$20.2 billion. This includes an anticipated increase of 4.3 per cent in the current year, IBISWorld said.

In 2016-17, aged careresidentsstumped up $4.5 billionto covertheir living expenses, care and accommodation, the governments Aged Care Financing Authoritys reported.

Residential care providersgenerated combined incomeof $17.8 billion, or $269.55 per resident per dayover the same period.

The aged care industrysrevenuesare expected to swell further, by around 4.4 per cent annually over the next five years, rising to $25.1 billion in 2023-24, according to IBISWorld.

Furthermore, the ongoing move towards a market-driven system of aged care is anticipated to boost profit margins over the next five years, IBISWorld said.

AnAustralian Nursing & Midwifery Federation report released in May found that in 2015-16, the six major companies alonebenefitted from more than $2.17 billion in taxpayer-funded subsidies, making after-tax profits of $210 million.

Bupa is the biggest player in Australias aged residential care sector. Photo: AAP

However, thereportalso found that the big sixs actual operating profits were much larger, and that they paid relatively little tax.

Australiaslargest for-profit aged care provider Bupa generated almost $7.5 billion in total income in Australiain 2015-16, but paid only $105 million in tax on a taxable income of only $352 million.

Bupas Australian aged care business made over $663 million in 2017 and over 70 per cent ($468 million) of this was from government funding, the report said.

Funding from government and resident fees increased in 2017, but Bupa paid almost $3 million less to their employees and suppliers.

It was a similar story for Opal, the second largest for-profit company with atotal income of $527.2 million in 2015-16,76 per cent of which came from government funding.

Yet Opal paidjust$2.4 million in tax on a taxable income of $7.9 million.

Allity had total income of $315.6 million, 67 per cent of which came from government funding, and paid no tax in 2015-16.

Regis, Estia and Japara appear to be using methods to reduce the amount of tax they pay while earning large profits from over $1 billion of government subsidies, the report said.

The report called for agedcares corporate giantsto beforced to become more transparent.

Companies that receive millions of taxpayer dollars via Australian government subsidies must be required by law to meet higher standards of transparency in financial reports and be publicly accountable, itsaid.

Aged care in Australia:Key facts and figures

The aged care sector generates annual revenuesof around $22 billion, the vast majority of which is government funded, according to the Aged Care Financing Authoritys2018 annual report released last week.

Theindustry services 1.3 million Australians, and consumers spentapproximately $4.8 billion on aged care in 2016-17 according to ACFA.

However,thesum does not include the refundable accommodation deposit paid by aged care residents, which ranges from hundreds of thousands to millions of dollars depending on the facility.

The pool of lump-sum accommodation deposits held by providers continues to grow, ACFA said risingto $24.8 billion as of June 30, 2017.

While the governmentcovers this cost for low-means pensioners, many nursing home residentshave tosell their home to fundthe deposit,which aged care providers hold and earn interest on from the time a resident enters a facility until theymove out orpass away.

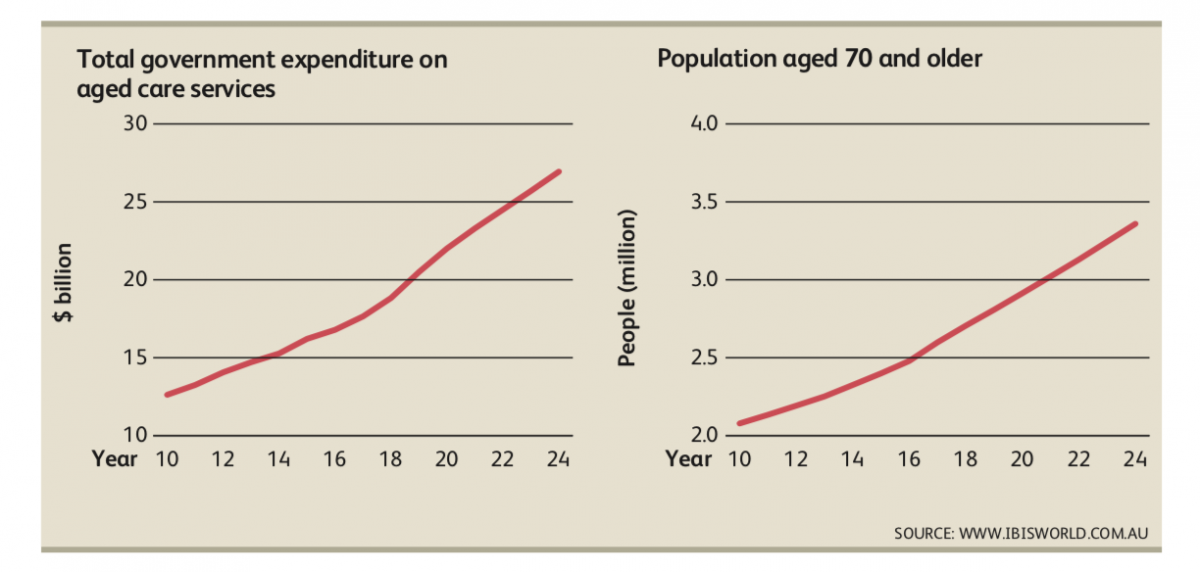

Total Australian government expenditure on aged care in 2016-17 was $17.1 billion, up from $16.2 billion in 2015-16.

Australias multibillion-dollar aged care industry is struggling to keep pace with an ageing population. Source: IBISWorld

Funding for aged care included:

- $11.9 billion for residential care

- $2.4 billion for home support

- $1.6 billion for home care

- $1.3 billion for flexible and other aged care

Governmentspending on aged care is expected to rise to$18.6 billion in 2017-18, and $22.2 billion by 2020-21, ACFA said.

This article first appeared in New Daily on 19 September 2018

John Menadue

This post kindly provided to us by one of our many occasional contributors.