KEITH MITCHELSON: Media advocacy for tax-avoiding, transnational behemoths the international fossil-fuel companies

June 17, 2022

_The web of international trade has been lauded for a century as a positive binding force connecting nations, making the world a safer place. Who would think it could also do the opposite.

_

Since antiquity a king owned all of his nations lands, and a kings wealth and power could only increase by invading and conquering the lands of others. This fired the endless wars and invasions which litter the history of all countries, East and West. This mode of politics still existed when trading capitalism was invented. Queen Elizabeth I funded Raleigh, Hawkins, Drake and others to piracy of Spanish treasure fleets and other trading rackets including slavery, rewarding some with knighthoods, and meanwhile taking a large cut of the plundered spoils.

The colonial conquest of the Americas, the Indies, and India by the Spanish, Portuguese, English, Dutch and others were essentially royalty-backed and funded ventures headed by companies specially created to plunder the riches of these new other worlds, perceived as less equipped to resist than neighbouring European nations. Similarly, the slave trade and slave-worked colonies of the Europeans, founded around sugar, spices and cotton, were developed by yet more companies funded by an entitled aristocracy empowered by their monarchs. As colony numbers grew, colonial empires were created to ensure colonies remained captive markets, policed by resident armies of soldiers, sailors and civil servants to reduce the financial risks.

Remarkably some of the current laws of trading capitalism were created in the medieval period under the divine rights of kings. These laws place the value of property and its ownership above the rights of all other people. Early company law formed to facilitate this new colonial trade is also remarkable. Traditionally only a living person could own property, so a company (a group of individuals) was vested with this individual right. But as it was a company none of the officers were responsible individually for the whole.

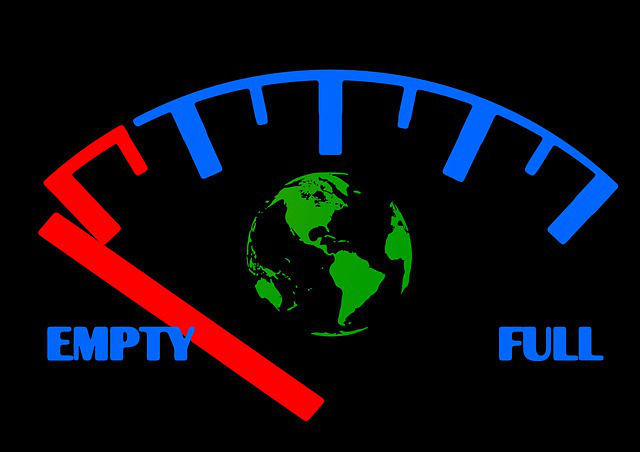

We see the consequences of these early laws even today when a company is held to account for a digression and no officer suffers consequences, yet some leading member(s) obviously ordered the digression. Over the centuries these compounding contradictions have created the world-wide havoc of uncontrolled mining, attendant environmental pollution, plastic pollution, and fossil-fuel fired global warming until the entire assembly of the planets life system is becoming at risk of extinction. Yet control of these adverse global processes seems to sit entirely in the hands of and at the behest of company interests, as governments seem unable to control events.

Companies have resisted any legal controls being imposed by national governments, and neoliberal leaning governments since Thatcher and Reagan have enacted laws that divest nations of virtually any control. Indeed, international trade laws are presently used to isolate the ownership of a previously national company from any legal jurisdiction of significance, locating their principal registered offices in nations with few resources except the crumbs offered them for residence. These residence lands each have low tax demands and poor business compliance laws, allowing the now retitled international companies to launder virtually all profits from their global trade to private shareholders, whilst avoiding contributing revenue to any higher taxing countries in which they operate.

The growing alarm and disquiet of the worlds peoples to the calamity of quickening global warming is slowly causing governments to initiate limited measures of control on fossil fuel emissions. This has made fossil-fuel companies rise against the possibility of falling profits, to offset this they are rapidly increasing price to maximize profits, as well as trying out strategies to prolong future consumption.

Who would have thought that a world-wide fuel supply crisis engendered by Russias invasion of the Ukraine would have been so effective - immediately the crisis commenced and global fuel prices sky-rocketed, Australian newspapers gleefully announced the growing windfalls for our fossil fuel companies, failing to note that none of the profits come back home. One hundred days later (and conveniently post-election) the global prices are hitting consumers pockets here too, just in time for the new government to inherit the God-awful regulatory mess left by Duttons neoliberal coalition.

As we hear daily, this global problem is one of supply chain disruption engendered by a Covid epidemic still besetting the world, compounded by a curtailed supply of gas from Russia escalating the global LNG price. Somehow though, supply chain constrains do not seem to limit gas being shipped out of Australia to international markets as fast as possible.

How new gas-fields being demanded to be opened here could possibly help us is inconceivable the time to production is too long for immediate help and the gas would be for export unless the east coast states agree reservation policies. The gas companies want to scare new production licences from governments frantic to be seen to be doing something.

Yet something much more sinister seems afoot. The Ukraine conflict seems to be settling down to a long slog, with the West unable to aid Ukraine sufficiently to drive Russia out, and Russia seemingly not wanting to conquer all rapidly. Although the IEA sees committed spending on renewables will increase this year on the last, they predict in year 2023 renewables spending may fall as policy is still uncommitted in significant countries, and the potentially resurgent Republicans in the USA favour fossil-fuels. The current energy crisis is prolonging advocacy for continuing (or even increasing) our reliance on fossil fuels.

Vladimir Putins good friend Donald Trump is preparing for another run at the US presidency in 2024, against attempts to bring serious charges against him before the mid-term Senate elections in November 2022. Rising costs of living and voter impotence were elements that propelled Trump into the White House initially in 2016. If the US Senate sees a Republican majority in 2022, and Trump is not barred, economic conditions may be conducive to re-win the presidency. If President Biden loses in 2024, the renewables inclinations of the US will falter completely affecting advocacy for amelioration of global warming.

The elevated gas price is causing inflation in the USA, the home of fracked gas. And windfall inflation is causing central banks to raise base interest rates which potentiate the prices of all commodities and services yet further. Some predict potential global economic downturn. Somehow all of this angst seems to reduce confidence for investment in new renewables technologies, whereas established fossil fuels appear safer bets. If I wasnt a realist, I could imagine the hands of powerful fossil fuel oligarchs behind all of these global events.

Our very own Rupert Murdoch, another good friend of Donald Trump, owns Australias Sky-News and News Ltd press. These companies are subsidiaries of his international company News Corp which includes the Trump advocating US Fox News and Britains News International. His outlets advocate in Australia for continuing fossil fuel use, deny global warming science and spruik Duttons opposition party as a virtual government in exile, while heaping continuous praise on the benefits to Australia of the gas price bonanza.

When so many international companies are domiciled in jurisdictions away from scrutiny, what is to prevent cartel-like behaviours. How can we know whether moves are afoot for regimes to expand fossil fuel use and hinder uptake of renewables, to prolong the era of high fossil fuel consumption and it attendant windfall profits. What a happy coincidence to have transnational oligarchs provide advocacy for those piratanical, tax-avoiding, transnational behemoths the international fossil-fuel companies.

Keith Mitchelson has a 40-year experience in academic and commercial biotechnology sectors in the UK, China, and Australia.