IAN MCAULEY. The finance sector: a drag on the real economy

December 4, 2017

The royal commission into the finance sector is more about detecting “misconduct” in individual institutions than exposing the ways in which the sector has misallocated investment funding and caused other economic distortions.

The finance sector’s attitude to the commission is that getting rid of a few residual bad apples is fine, but if it goes further it risks damaging the sector and the strong credit ratings of Australia’s banks. The bankers, who have had a hand in drafting the terms of reference, assert that the sector is too important to the Australian economy to be subject to such risk.

The finance sector is surely over-stating its own importance. Contrary to the way it may present itself, it is not a generator of wealth. Wealth is created in the real economy – where people grow food, build houses, care for the sick, teach children and so on – not in the so-called “paper” economy.

The finance sector’s function is to facilitate transactions in the real economy, to mediate between savers and lenders, and to help people spread risk through insurance. Anything more is puffery.

These functions are unexciting but essential economic services, and until about thirty years ago the finance sector was seen in the role as a service to the real economy and as a necessary overhead. Banking or insurance were where you went to work if you were apt to find the public service too stressful. If you were a cautious investor seeking secure but modest returns, you bought bank shares.

It was also the sector most likely to benefit from productivity gains resulting from information and communication technologies, and indeed that has occurred. You don’t have to go back far in time to remember queuing at tellers to withdraw cash and deposit cheques and the hassles of arranging finance when travelling overseas. If you were in a small business you had problems with dud cheques and long nights using a calculator to reconcile your ledger with your bank statements.

So with all those labour-saving technologies you might expect that the sector has been able to become leaner and more efficient – providing the same level of service from a smaller base.

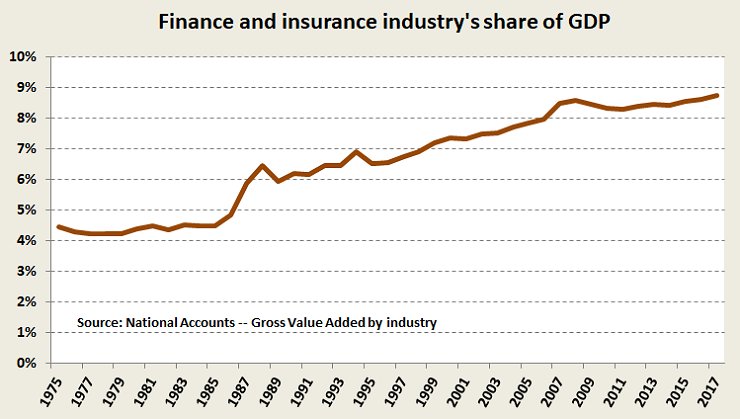

But that hasn’t been the case. It has grown. Since the mid 1980s, when the Hawke-Keating Government largely deregulated banking, the sector “finance and insurance” as defined by the ABS has doubled in size as a share of GDP, and it keeps growing.

Among comparable “developed” countries, Australia now has one of the world’s largest finance sectors relative to the size of its economy. In a 2014 paper Professor Rodney Maddock, former chief economist for the Business Council of Australia, points out that Australia’s financial sector’s share of GDP is larger than that of the Euro area (where it has remained at about five per cent of GDP), Japan, the USA and Canada. Germany gets by with a financial sector that’s only 3.9 per cent of GDP.

Drawing on IMF data ABC business reporter Michael Janda reveals that Australia’s bank profits are 2.9 per cent of GDP – the highest among the ten countries on which he reports. That’s $51 billion, or around $6000 per household, and that’s without accounting for outrageous executive salaries. As economists know, enduring high profits in any industry is a pretty sound indicator of a lack of effective competition. (Australian governments tend to see competition only in terms of the numbers of players in the market, rather than in terms of whether or not consumers gain any benefit, but that’s another story.)

Maddock concludes cautiously that the finance sector in Australia is probably too big. A 2015 paper produced for the Bank of International Settlements is more definite: there is a negative relationship between the rate of growth of the financial sector and the rate of growth of productivity across the economy as a whole, and “financial growth disproportionately harms financially dependent and R&D-intensive industries” (a point which any indebted farmer may have made in more colourful language).

The authors, Stephen Cecchetti and Enisse Kharroubi, attribute this in part to the financial sector’s drawing skilled workers away from other industries. In many countries, including Australia, there are many skilled engineers who could be contributing to the real economy but who have been lured into the finance sector.

Then there are particular Australian factors where the financial sector may be dragging on the real economy. As Ross Gittins writes there has been a “litany of misconduct by the big four banks”, including bad investment advice, possible manipulation of the bank-bill swap rate, and facilitation of money laundering. These behaviours have raised public outrage, but they are also behaviours that have led to economic distortions.

To Gittins’ litany may be added imprudent lending for housing, abetted by government policies on “negative gearing” and capital gains taxation. Banks have responded to these incentives by lending for mortgages rather than businesses, thus feeding a speculative positive feedback loop of rising debt and rising house prices. Reserve Bank Governor Philip Lowe in a speech last month raised a concern about the high level of housing debt affecting the stability of the rest of the economy. A “stable” finance sector can contribute to instability in the real economy.

The Government’s press release and draft terms of reference reflect the public outrage, the insistence of the National Party, and of course they incorporate an attempt to have a go at the industry superannuation funds. (It’s a hanging offence for organizations part-controlled by unions to perform better than their competitors in the respectable established financial sector where the Coalition’s mates reside.) Notably, they seem to exclude the health insurance industry, the behaviour of which has rendered them no more loved than the big four banks.

As political statements, the Government’s documents read more like a review by a state consumer affairs department considering errant practices in the used car or real estate industry rather than a review of the sources of these behaviours and any resulting systemic economic distortions. The commission’s official title is into “misconduct” in the industry. (It’s “alleged misconduct” in the Prime Minister’s press release, as if it’s all only a fiction of the imagination of disgruntled Labor and National politicians.) As Greg Jericho has written, “you could be excused for believing are designed to produce little change to our financial system,”.

Also, there is a risk – an understandable one – that the commission’s attention and that of the media will be solely focussed on banks. But the terms of reference also include general insurance, and this is an industry whose practices have avoided scrutiny for many years.

While there is awareness of people’s poor insurance claims experience, such as the troubles Comminsure policy holders had with life insurance, there is far less public awareness of the management expenses borne by everyone who insures their house, motor vehicle or small business. For example, in houseowners’/householders’ insurance, only 64 cents in the dollar paid in premiums is returned as claims paid. Even the health insurers do better! Like the health insurers, general insurers make their money by selling people cover they don’t need, while leaving them exposed to open-ended risks.

The Commission’s draft terms of reference start with the preamble “Australia has one of the strongest and most stable banking, superannuation and financial services industries in the world, performing a critical role in underpinning the Australian economy.”

Few would dispute the first part of that statement, but there is no intrinsic virtue in “strength and stability”, particularly if it has come about through a lack of competition and contempt for customers. In any event the stability of the finance system is not under question – it’s the stability of the real economy that counts.

And the “underpinning” reference is wrong spatially: the finance sector is not a base for other industries. It’s a bloated overhead.

_Ian McAuley_ is an Adjunct Lecturer in Public Sector Finance at the University of Canberra and a Fellow at the _Centre for Policy Development__._