Reconstruction of war-torn Afghanistan, Ukraine will enrich China and US

August 16, 2023

At this moment in the economic cycle the Chinese economy is stalling whilst the US is experiencing a buoyant phase. However, there is another angle to their strategic rivalry that is more important than ephemeral shifts. Viewed through a longer lens both China and the US have economic aces up their sleeve. Both possess a counterweight that helps insulate them from low-growth traps.

Overseas investment income courses through the veins of the economy of those drawing tribute from overseas. And today two economies offer the prospect of adding to the tribute flowing to China and the US. For the Chinese it is Afghanistan and for the US it is Ukraine that stand on the threshold of becoming highly profitable zones. Two war torn countries are on the cusp of enriching their economic partners. They will increase the national income of two great powers engaged in a battle to export capital in order to expand the field of profitable investment and buttress domestic growth rates.

Being the graveyard of empires has inflicted long term damage on Afghanistan. But two years after the US withdrawal there is the prospect of a new dawn. China has rushed to fill the vacuum left by the US. The US was conscious that Afghanistan was a minerals hub, but its quick exit destroyed its economic aspirations. China is being savvy in Afghanistan. While it pressures the Taliban to abolish its social policies excluding women from education and civil society it scours the country for economic opportunities.

China is making a hardnosed bet on the future of Afghanistan. And Afghanistan has all the appearance of shrugging off its underdeveloped status. The US could never stabilise the country sufficiently to unleash its mining companies in Afghanistan. In stark contrast Chinese geologists and mining companies are exploring every nook and cranny. They are being egged on by the Taliban government. The Chinese are being given a free hand to explore for the green metals that will fuel a clean energy future.

Afghanistan has staples like oil and gas, but the Chinese are after bigger fish. They know Afghanistan has the potential to become the Saudi Arabia of many of the critical minerals that will contribute to a high-tech, low carbon economy. The estimated copper reserves are eye-watering. This is coupled with untapped rare earth metals and reserves of aluminium, cobalt, gems, gold, graphite, nickel, silver, zincand the chief prize, lithium.

There is an insatiable global demand for lithium, as it is an essential factor in batteries powering portable technology and electric vehicles. China is committed to investing billions in Afghanistans lithium mining sector. The mines will be large scale employers and come with infrastructure that will include tunnels, a power dam and highways. Afghanistan will have an equity stake and not just be dependent on royalties in the joint mining ventures that China undertakes on its soil. For China its commanding role in refining and processing critical minerals will be further entrenched. Its minerals supply chain will receive a fillip. A green metals rush will pay off in repatriation of profits and bolster the order books of the Chinese manufacturing and construction businesses engaged in supplying Afghanistan public works.

China is not interested in an imperial crusade built on colonial conquest. It realises that route is costly and pass. It is building an informal empire without colonies. It aims to be the hegemon in Eurasia without resorting to colonies. Russia is not a stumbling block. It is overstretched, but more crucially it lacks the deep markets and investment pools that China can offer to prospective partners in Eurasia. Chinese geopoliticians realise dominance in the landmass of Eurasia makes you invulnerable, and rivers of direct investment are the key to hegemony. Saving a big slice of its GDP aids Chinese business capital outflows.

China is in a sense taking a leaf out of the American book in seeking an informal empire. However, the US covert form of imperialism, built on the export of capital, has become blurred. Old style military interventionism has too often been its calling card. But in Ukraine it will rely on a classic form of covert imperialism based on direct investment to fully bring Ukraine into its orbit once the fighting stops.

The US is committed to drawing a line in the sand against Chinas ambition to make Eurasia its sphere of influence. For the US, Ukraine is pivotal in its strategy to turn the tide and secure hegemony in Eurasia. Thus, the US must control the post-war reconstruction of Ukraine, and it is clear the Ukrainian government is signed on to US aims. Even as the artillery roars on the battlefield, measures are underway to implement the neoliberal agenda that will insert Ukraine into the informal empire of the US and facilitate its Eurasia mission.

Ukraine has deregulated its labour market. Henceforth trade unions will be shackled. A move to unleash full-scale privatisation and liberalisation is in train. This will be exponentially increased post-war as US finance capital leverages its iron grip on Ukrainian debt to impose a structural adjustment program fast-tracking free market reforms. With the task of abolishing opposition parties completed this project has been made easier.

The full gamut of labour market reforms is being implemented. Collective bargaining has been dismantled and replaced by individual contracts accompanied by scrapping minimum wages. It has become easier to fire workers. Zero-hour contracts are another feature. The upshot is insecure employment and a boost for managerial prerogatives.

US financial institutions led by BlackRock, a giant asset management firm, and the bank J P Morgan have been delegated by the Ukrainian government to mobilise the funding of post-war reconstruction. They have a green light to offer unfettered access to US multinationals and the Europeans lucky enough to get a minor cut of the economic pie. State and private assets will go at fire sale prices once the war is over as pressure to service stratospheric debts incurred during the war will be overwhelming.

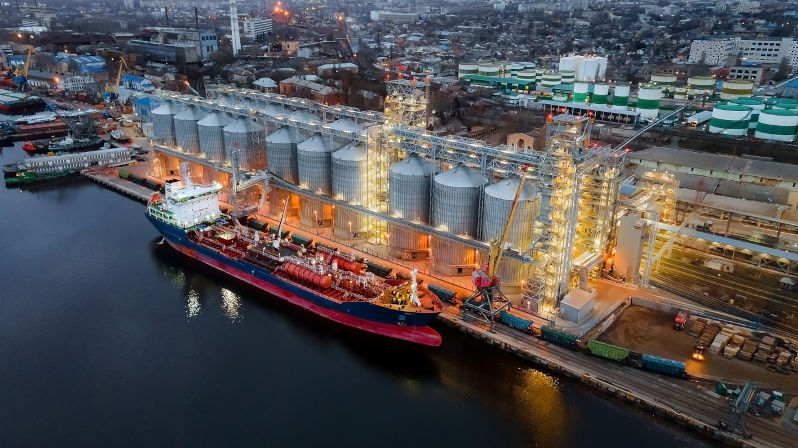

Take land as just one investment opportunity. Land reform allowing foreign ownership has been implemented. Pre-war Ukrainian oligarchs controlled substantial estates, but they will be forced down the pecking order as giant US agribusinesses undertake a takeover spree. The war emergency has prompted the state to requisition a range of firms owned by oligarchs. Once the shooting war stops, the state and cash strapped private owners will unload prime agricultural property to US agribusinesses. Local small and middle land holders will along with oligarchs bear the brunt of the US agrarian takeover. Before the war Ukraine was the biggest global exporter of corn and wheat. It produces a range of other large scale profitable agricultural crops.

The US-owned Cargill multinational, the worlds largest grain trader, will be on hand to service the growing role of US agribusinesses based in Ukraine. Cargill has port facilities in the Black Sea region available to distribute Ukraines food production worldwide. Hitler eyed the rich black soil of Ukraine, and control of it was a keystone of his Lebensraum program. US investment capital poured into buying Ukrainian farming land and other sectors will secure what Hitler was never able to consolidate.

Capital exports rule the world. They underpin geopolitical strategic competition. Politics is concentrated economics. The epic battle for control of Eurasia is being mainly conducted through the instrument of Chinese and US direct investment. It was the British and Russian imperial regimes that conducted the Great Game in the nineteenth century aimed at dominating Eurasia. Today China and the US have stepped into their shoes and Afghanistan and Ukraine are component parts of a competitive struggle in a vast landmass. Who rules Eurasia controls the world is a wise maxim. For two contemporary peer competitors the prize is an El Dorado of wealth and powerand it will settle who wins the latest Great Game.