TIM COLEBATCH. Underestimating China.

June 10, 2018

Lets clear up any confusion about the size of the Chinese economy.

Which is the worlds largest economy: China, or the United States? You can be excused for not having a ready answer. On the one hand, you read that China is already number one: that it overtook the United States back in 2014. Then you read other experts asserting that no, America is still way ahead, and it will be 2030 or later before China catches up.

One of those experts is defence and strategic analyst Alan Dupont. In the middle of a valuable contribution to the China debate in last Saturdays_Australian_, he strayed from his own field of expertise to assert flatly that the idea that China is the worlds biggest economy is a falsehood created by Chinese myth-making. He wrote:

In last years respected Pew Research Center poll, seven out of ten European countries surveyed and two-thirds of Australians thought China was the worlds leading economy. In reality, China is still behind the US on most key economic indicators and has the second-largest economy ($US14 trillion) after the US ($US20.4 trillion), according to the International Monetary Fund.

Dupont, the author of the Coalition governments defence white paper, is a respected thinker and his article makes many good points. But he is not an economist. His unfortunate_obiter dictum_misrepresented both the IMF and economic reality and creates an important flaw in his strategic analysis.

Fortunately, the Pew Research Center poll tells us that most Australians and Europeans have the story right: unless its GDP figures are even more unreliable than most critics think, China is already the worlds biggest economy.

Yet we keep reading financial market types forecasting that China will overtake the United States in a decades time. And if someone as smart and otherwise well informed as Alan Dupont doesnt understand how to compare the size of different economies, theres probably a lot of readers who would like an explanation of why they keep seeing two very different versions of this story.

Lets start with two countries. Well call them Australia and Indonesia.

This year the IMF forecasts that Australias total output of goods and services what we call gross domestic product, or GDP will be worth A$1877 billion. Across the Timor Sea, the IMF forecasts that Indonesians will produce goods and services worth 14,776 trillion rupiah. How do we compare the two?

Theres a simple way: just use the current exchange rate to convert the two into the same currency. Thats what Dupont and the financial market people like to do. This has its uses, and some countries have their own reasons for preferring it. So the IMF does publish these figures, although it rarely uses them in its own analysis.

Australias exchange rate is overvalued. Although far lower than it was five years ago, our dollar is still so high that we are the most expensive G20 country to live in, and the only one where goods and services typically cost more than in the United States. Indonesia, by contrast, has only just regained its investment-grade status from the credit ratings agencies, and the rupiah is not a currency the traders buy much of. As tourists will recall, its roughly 10,000 rupiah to one Aussie dollar.

The bottom line is that if youre using exchange rates to compare the two economies, then Australia is the bigger of the two. The IMF estimates that its GDP this year will translate to US$1500 billion, whereas Indonesias GDP, converted by exchange rates, would total only US$1075 billion.

But what does that tell us? If youre an exporter anywhere else, it tells you that Australia is a bigger_market,_in terms of potential sales measured in a global currency. If youre in the finance sector, it is a convenient baseline for measuring foreign debt, which has to be paid off and serviced in global currencies. For transactions that require foreign exchange, the foreign exchange measure is the right one to use.

But it is not a measure of output. It is a measure of output and prices combined.

Suppose you go to see a film in Australia. Prices vary, of course, but youll probably pay something like $20 per seat. Go to see the same film in a typical Indonesian shopping mall and youll probably pay the equivalent of about $3 a seat, or $5 in the most upmarket cinemas. But its the same film, and even the cinemas are not that different. Its the price thats different.

The exchange-rate measure of comparative GDP assumes that seeing the film in Australia is at least four times as valuable as seeing it in Indonesia. Thats rubbish. The exchange-rate measure of size is as meaningful as one of those halls of mirrors that make you look very long and thin or very short and wide depending on how the markets rate your currency.

Thats why economists long ago invented a better measure: investigate prices for a range of goods and services in each country, then use that as a benchmark for estimating the relative size of each economy. The British-Australian economist Colin Clark was the first to attempt this in 1940, but only in the last generation has it gained worldwide currency.

Its called purchasing power parity, or PPP. Its a rough measure, and it involves lots of judgements about the relative quality of goods and services. But it is a much better measure than the simplistic exchange-rate method. It measures not the bucks you spend, but the bang you get for them.

That is the measure the IMF uses in its analysis. Here is its list of the twenty largest economies on a PPP basis and, for comparison, the top twenty using exchange rates:

It is based on the inescapable fact that $100 buys you a lot more in some countries than in others just as, by and large, $100 twenty years ago bought you a lot more than it does today. You cant compare the volume of goods and services produced in different countries or different ages without comparing their prices.

The current benchmarks were set in 2014 by the International Comparison Program, a detailedglobal reviewof price levels in each country initiated by the United Nations and subcontracted to the World Bank. Australia has played a big part in spreading PPP comparisons from Western countries to the whole world. Former Australian Statistician Ian Castles was a driving force, one of his successors, Dennis Trewin, chaired the 200508 international price review, and senior Australian Bureau of Statistics official Paul McCarthy played a key role in the latest one.

As the table shows, most Western countries have a slightly larger GDP when expressed in real (PPP) terms than when expressed in the nominal (exchange-rate) measure; Australia is the exception. But the big difference is in developing countries. Brazils GDP is 50 per cent higher in real terms, Chinas is almost double the nominal measure, Russias is two and a half times bigger, Indonesias three times bigger, and Indias fully three and a half times bigger than its nominal measure.

Think of it as having US$1000 to spend. In China, it will buy you goods and services that in the United States would cost you US$1790. In Indonesia, you could buy the equivalent of almost US$3250 of American goods and services; in India, US$3650. But in the United States, US$1000 will buy you only US$1000 of stuff and in Australia, you would get only a basket of stuff that would cost US$875 in the United States.

That is the real world, not the nominal one. It is measured by purchasing power, not exchange rates. It recognises that we spend most of our money to purchase services, and most of those services are not traded on global markets.

Our AustraliaIndonesia comparison looks very different in real terms than in nominal ones. The real Indonesian economy is far bigger than the real Australian one: within five years, the IMF projects, it will be three times bigger than ours which is hardly surprising, as Indonesia has ten times more people.

And the ChinaUS comparison also looks very different. At face value, the US economy is 44 per cent bigger than Chinas in nominal terms. But in real terms, the IMF estimates, the Chinese economy is already 24 per cent larger than its American counterpart, and in five years time it is projected to be more than 50 per cent bigger. Project that out to 2030, as in last yearsforeign policy white paper, and Chinas economy is expected to be almost twice the size of the US economy:

In this scenario, India would overtake the United States during the 2030s to become the worlds second-biggest economy; and, with a population still growing while Chinas is shrinking, it will start to gradually haul China in. But we may be facing a long period in which China will be not merely the largest economy in the world, but the dominant economy the largest by a very long way.

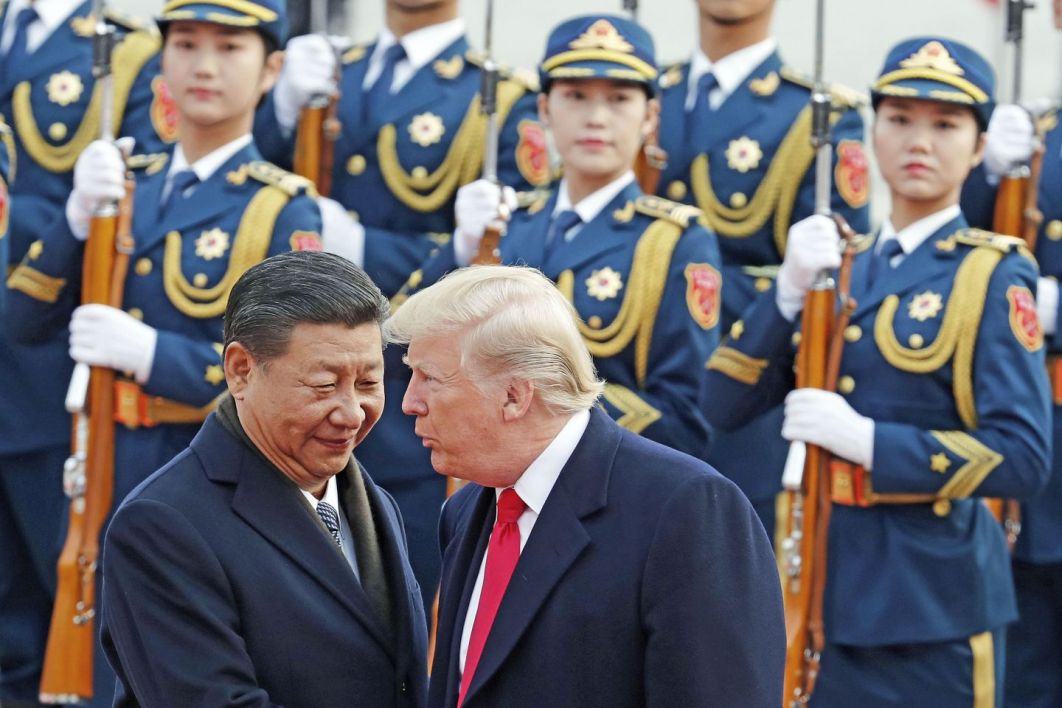

Military experts like Dupont assure us that the United States will still remain the worlds greatest military power for now. But if these projections are right, then Chinas superior economic weight would eventually lead to military superiority. And long before then, if not already, it will be the dominant military power in our part of the world, as US military strength is dispersed around the world.

The implications of that are serious indeed. If China can put a ship to sea, or build a missile, at far less cost than the United States, then using exchange rates to gauge their relative power leads to fundamentally flawed conclusions. (This is why China, far from spreading the PPP myth, as Dupont states, for many years insisted that the World Bank cling to the old exchange-rate measure. It was simply following Deng Xiaopings edict to keep a cool head and maintain a low profile.)

What kind of rule would China seek to impose if its dominance of the region grows to be beyond challenge, even by the United States?

A caveat must be inserted here. The IMFs figures and the foreign affairs departments projections both assume that Chinas GDP figures are correct, and that China will not suffer an economic downturn in the foreseeable future.

Both assumptions seem to me unlikely to be borne out in fact. I havewrittenhere before of my (and others) scepticism about Chinese GDP numbers. They remain now, as then, a product of political propaganda. One of the giveaways is that thehistorical dataChina supplied to the IMF implies that in 1980, about the time its reforms began, China was the second-poorest country in the world, behind Mozambique (where a civil war was raging). If you believe the Chinese figures, then the China of 1980 a nuclear power with a large army, a country with long-established cities and a hard-working people, almost self-sufficient in technology was far poorer than Bangladesh or Mali, and barely half as well off as India (which really was poor in those days). Who believes that?

Even so, the real question is: are they far out? And they probably arent. On the IMFs figures, Chinas real GDP per head is now a bit above the global average, in the same ballpark as Brazil, Mexico, Iran and Thailand. I may be ill informed on this, but Im not aware of any chorus of voices arguing that it doesnt belong in that group. Its_real_real GDP is probably lower than the stated one, but no one knows how much lower.

Further, its unlikely that China will escape its massive debt binge of the past decade without a heavy economic fall. Australia also faces the same threat, but the risks in China are far worse. Far more debt was ramped up there far more quickly and the money was lent on the basis of political influence, not the likelihood of repayment. China is not immune from the laws of economics. President Xis campaign to reduce debt throughout the economy comes years too late.

To my mind, determining what should be our policy towards China is the single most important issue facing Australia today indeed, the most important issue Australia has confronted in my lifetime.

The problem is not simply trying to guess what China might do under this leader, but also trying to guess what it might become and do under subsequent leaders brought up on his attitude that the party rules everything, only Chinas interests matter, and if smaller countries get in the way of them, they should be bullied into submission.

We dont want China to be our enemy, but it seems to want to be one so far, admittedly, in minor ways designed to annoy rather than threaten us. I make no claims to be an expert on China, and I read avidly those who are, at places like theLowy Institute, inEast Asia Forumat the Australian National University, and at theAustralian Strategic Policy Institute.

It is important that when we make our choices, we are well informed by accurate data, not fed on fantasies.

Fifty years ago, Australias GDP was nearing A$30 billion. Today it is about A$1800 billion. Does that mean we are sixty times better off now than we were then? Thats the same logic as Dupont and others use when they offer us inter-country comparisons of GDP using the simplistic exchange-rate measure.

In economic measurement, prices matter. China has controlled its exchange rate, contained wage and price growth, and hence maintained some of the appearance of a low-income country as it has matured into a high-tech, upper-middle-income one. We should not underestimate it. And we should not underestimate the scale of its economy, now the largest in the world.

This article was published by the Inside Story on the 7th of June 2018.

Tim Colebatch is a regular contributor to Inside Story, and a former economics editor and columnist for the Age.