Why is America so reluctant to acknowledge Chinas economic power?

June 14, 2023

The statistical evidence clearly shows that China is the world’s number one economy. Unfortunately, the US and many commentators are unwilling to acknowledge that reality, but the future stability of the region depends on acceptance that we are living in a multipolar world.

For the last hundred years America has been the worlds biggest economy, and this has underpinned US military power and its claims to world leadership. But can these claims to leadership and the US notion of itself as exceptional survive if America is no longer the number one economic power?

Less than a decade ago, there was a widespread consensus among the experts that Chinese economic growth would lead to America losing its number one position. For example, the Australian Treasury estimated in 2017 that by 2030 Chinas gross domestic product (GDP) would be US$42.4 trillion while Americas would only be $US24 trillion or not much more than half Chinas.

Now six years later almost all writers, including those writing for Pearls & Irritations, continue to believe that China still has not caught up. They regularly describe China as the second biggest economy in the world.

Furthermore, since Covid various experts have started to question whether China will ever overtake Americas economy, and even if it does they argue that it will not be by much.

Thus, The Economist magazine in its May 13 issue endorsed the view of two American scholars in their book, Peak China, published last year, that China has peaked already. The authors, Hal Brands and Michael Beckley, argue that China is facing decay with a declining population and that productivity will suffer as Mr. Xis autocratic policies are making entrepreneurs more nervous and reducing Chinas capacity to innovate.

The Economist cites various analysts who have cut their long-term forecasts for Chinas economic growth. Because of assumed lower future productivity growth, they now forecast that in 2050 Chinas economy will either be not much larger than Americas or even not as large, depending on small variations in the assumed rate of productivity growth.

But to be frank, as will be shown below, these conclusions represent a combination of disregard for the statistical evidence and wishful thinking.

How big is Chinas economy today compared to Americas?

Despite the regular descriptions of China as the second biggest economy in the world, the statistical evidence shows that is just not true. If properly measured the Chinese economy is already the biggest in the world.

The problem is that most international comparisons of economic welfare and economic capacity are based on national estimates of GDP adjusted to a common currency usually the US dollar using the current exchange rate. But exchange rates are affected by a host of other factors, and do not correspond closely to the differences in price levels between countries.

Instead, as all statisticians know, international comparisons of the size of GDP should be based upon purchasing power parities (PPPs). These PPPs are the price relatives that show the ratio of the price in national currencies for the same good or service in different countries.

The aggregate PPP which is used to compare different countries GDP and GDP per capita is then a weighted average of all the individual PPPs for the different goods and services produced. As such the aggregate PPP represents the rate of currency conversion that exactly equalises the purchasing power of different currencies by eliminating the differences in price levels between countries.

For example, a basket of goods and services that costs $100 in America costs only about $60 in China. This means that Chinese goods and services are much cheaper than their American equivalents adjusted by the exchange rate. It also means that the US dollar is seriously overvalued and that its use exaggerates the value of US production and consequently the size of the US GDP relative to other countries.

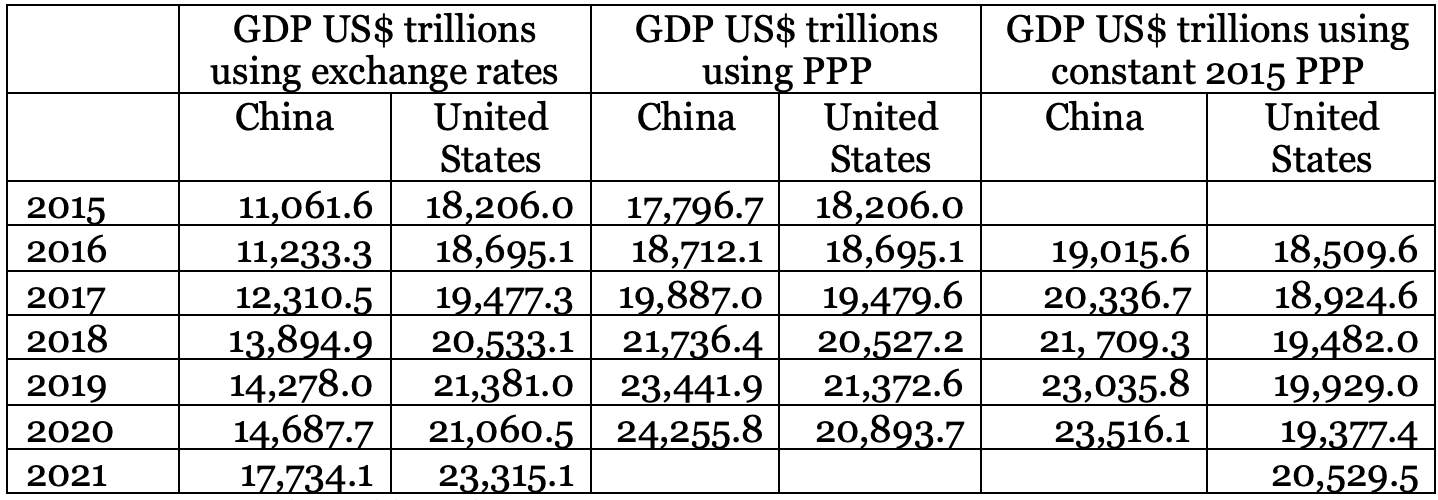

Thus, as can be seen in Table 1 below, if we use exchange rates, in 2021, the most recent year for which data are available, the US GDP is $21,060.5 trillion which is substantially larger than the $17,734.1 trillion for China. However, if we use PPPs in 2020 (the latest year for which data are available) then the US GDP was only $20,893.7 trillion, significantly less than the Chinese GDP for that year which was $24,255.8 trillion.

Table 1 Comparison of US and Chinese GDPs

Furthermore, as can be seen, China overtook the US GDP and became the biggest economy in the world back in 2016. And since then, the average annual growth rate of the Chinese economy in constant PPPs has been 5.5 per cent, while the US growth rate has only been 1.4 per cent.

Future Chinese economic growth relative to Americas

The other bit of wishful thinking is that Chinas economic growth will slow so much that it will not be significantly faster than the pace of US economic growth.

Like most economies as they mature, Chinese economic growth has slowed in recent years from the high rates of around 10 per cent per annum recorded as China opened up and took off. But even if we take the evidence of the last few years, Chinese GDP growth at an annual average growth rate of 5.5 per cent is still nearly four times as fast as Americas growth rate.

Also, the assertion that Chinese capacity to innovate is falling off, is another example of believing what you wish for. Even the Australian Strategic Policy Institute no friend of Chinas has found that China is the leading country in 37 of the 44 new technologies that matter most for the future.

The reality is that the US productivity growth rate has declined too. Indeed, the US has a fundamentally flawed economic strategy, with a structural budget deficit of around 7 per cent of GDP which is putting upward pressure on its interest rates and the exchange rate.

The US likes to blame China for a loss of markets, but it is Americas overvalued exchange rate that is principally responsible for its balance of payments current account deficit equivalent to 3.8 per cent of GDP in 2022, while China had a surplus equivalent to 2.7 per cent of its GDP.

This over-valued US dollar exchange rate is reducing the competitiveness of US industries and thus reducing their future growth prospects. And it is no good blaming China as Trump in particular did, but Biden has not changed course either.

Conclusion

Australian planning needs to recognise that China is already the most powerful economy in the world, and that its relative power is likely to increase further.

As Major General Michael Smith (Retd) said in a recent article in Pearls & Irritations, The global balance of power, particularly in the Indo-Pacific, is not changing, it has already changed. As General Smith went on to say: China has already become the major power in Asia and it will no longer accept containment and economic sanctions by the United States and its allies.

It therefore makes sense for Australia to pursue policies that encourage the acceptance of a multipolar system of international governance. In particular, the best thing that Australia can do as an ally is to encourage and help the US to accept the reality of its situation that it is no longer a sole hegemon.