Will the iron ore bonanza be repeated with “green” steel?

October 2, 2024

Iron ore has underpinned Australia’s prosperity. Gas and coal exports are bound to fall as market countries cut their carbon emissions. Can we build our future on “green” steel?

Australia’s number one export today is iron ore. In 2023, our miners shipped out around 900 million tonnes of ore worth $124 billion. This amounted to half of the world’s supply.

This trade is extremely profitable. It has made “Twiggy” Forrest a billionaire and has added to Gina Rinehart’s fortune. It makes a motza for BHP and Rio Tinto. It earns Canberra around $15 billion in company tax each year and gives Western Australia $10 billion in royalties.

Perhaps, in a better system, some of this bonanza could have been salted away in a sovereign wealth fund.

Why are we so lucky?

We are fortunate to have enormous deposits of high-quality iron ore, most of them in the Pilbara region of north-west WA. The big miners – BHP and Rio Tinto and more recently Fortescue – have developed large-scale operations that extract the ore and put it on a ship at low cost. Estimates are that it costs as little as $20 for the big miners to mine a tonne of ore, ship it to the coast and put it aboard a bulk carrier. The price of ore has been above US$100 per tonne for the last few years.

The astonishing growth of China’s economy in recent years has driven demand for steel, keeping iron ore prices high. China’s growth has faltered lately, and the price has slipped, but it is still above US$90.

We are doubly fortunate that the cost of shipping ore to China (and to Japan and Korea) is much less from our North-West than it is for competing producers in Brazil or South Africa.

Nevertheless, China (and Rio Tinto) are investing now in a big new mine with a railway and port in Guinea, West Africa. This will diversify China’s sources and enable it to put downward pressure on prices. This is not the only cloud on the horizon for Australia’s iron ore.

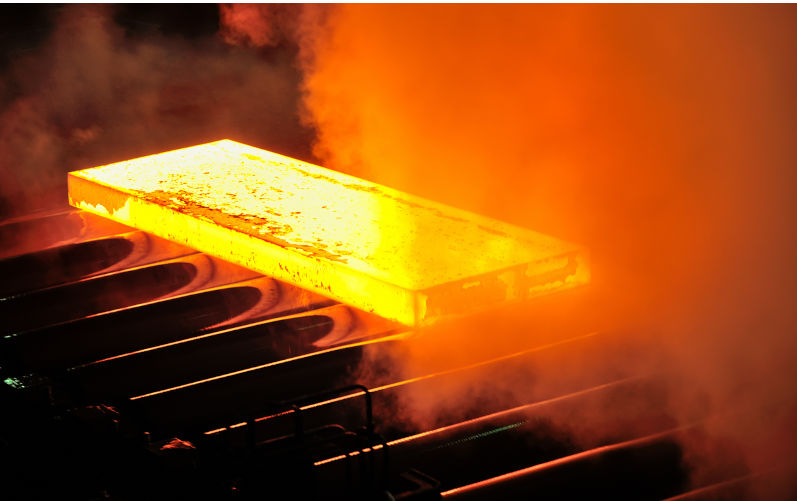

Making steel

Steelmaking is one of the largest heavy industries. It accounts for seven or eight percent of the world’s total carbon dioxide emissions and so is a significant driver of climate change.

Most new steel is made by a process invented centuries ago. In the first of two steps, iron ore is “reduced”, i.e. stripped of its oxygen atoms, by carbon monoxide in a blast furnace. The carbon monoxide comes from coke, which is derived from coal. It ends up as carbon dioxide and is “vented” to the atmosphere.

An alternative first step, called direct reduction, is used for about five percent of the world’s new steel. In this process, iron ore of high grade is “reduced” in a kiln or furnace fired by fossil gas, which is mainly methane. The carbon dioxide emissions are comparable to those from a blast furnace.

The second step involves refining crude iron in a basic oxygen furnace or an electric arc furnace. Metals or other materials can be added or gases can be removed by vacuum to produce various steel grades. The steel can then be rolled, cut or coated to fit customer needs.

Towards “green” steel

Efforts are under way in many countries (including Australia) to develop new processes for steelmaking with much lower, even zero, carbon dioxide emissions.

One of the most promising processes for making “green” steel is based on reducing iron ore in a specialised direct reduction furnace fired by “green” hydrogen. Hydrogen atoms combine with oxygen from the ore to form an exhaust of steam or water vapour.

“Green” hydrogen must be made by splitting water into its constituent hydrogen and oxygen using renewable electricity. Most hydrogen made today for use in making ammonia, fertilisers and explosives is not “green”. It is made from fossil gas or coal, once again with large amounts of carbon dioxide “vented” to the atmosphere.

A Swedish company, SSAB, produced the first “green” steel by hydrogen reduction on a pilot scale in 2021. It hopes to achieve commercial production by 2026. A rival, Stegra (formerly H2 Green Steel), also in Sweden, may beat them to it. These projects are being helped with public investment in the billions of euros and a price being applied to carbon emissions across all industry. It will probably take quite a few years and large amounts of investment to bring this process to a stage where it will be competitive with traditional steelmaking.

“Green” hydrogen itself has a way to go before its cost falls to a level competitive with alternatives, except where a steep price is applied to carbon emissions.

Research is going on into other methods of making “green” steel. For instance, some scientists hope to use hydro metallurgy to refine iron ore to a grade suitable to be mixed with old scrap steel and fed directly into an electric arc furnace.

Continuing demand

China produces more than half the world’s steel. Its economy is now off the boil and is shifting from being overweight in construction towards more consumer products and services. We can expect a continuing but slowly dwindling demand for iron ore as China closes its oldest and most decrepit traditional steel plants and eventually builds plants to make “green” steel.

Prices of iron ore will probably be much lower than in recent years, but still high enough for some supply to come from other sources in Brazil or Africa. This should keep the Australian industry profitable but at levels well below the recent bonanza.

“Green” steel in Australia

Once again, we seem to be the lucky country. The Pilbara region is blessed with excellent potential for wind and solar energy that could power a “green” steel industry.

However, there is a hitch. Pilbara ore is mostly the mineral hematite, which is well suited to blast furnace steelmaking. However, hematite is not ideal for direct reduction furnaces, whether powered by hydrogen or fossil gas.

Magnetite, the other main iron mineral, is less common in the North-West. It has a lower iron content when mined but can be beneficiated by magnetic separation of impurities. The beneficiated product is preferred for direct reduction.

This hitch may yet be overcome by research or by favouring magnetite mining.

The Brazilian giant Vale already markets “DR Grade” iron ore, developed for direct reduction furnaces that use fossil gas. Rio Tinto can supply a similar product from Canada. These companies are likely to supply the new Swedish “green” steel plants and other possible ones in the Middle East and elsewhere.

Fortescue already produces some “DR Grade” ore in Australia and plans to develop a mine in the Pilbara (and possibly one in Gabon, in West Africa) that will mainly produce hematite.

Australia has a second, smaller iron ore province, in the Eyre Peninsula of South Australia. Its ores are predominantly magnetite. This area, too, has excellent potential for solar and wind power. It could host a “green” steel industry.

Wherever an Australian “green” steel plant using hydrogen is located, it needs to be close to a reliable, very low-cost 24x7 source of renewable energy. Hydrogen is best used right where it is made. Moving this least dense of all gases over a distance is just too expensive.

To manage inventories and lead-times efficiently, steel companies like to locate the second production stage close to their customers. For this reason, it is probable that an Australian “green” steel industry will focus on the first process step, exporting products such as Direct Reduced Iron or Hot Briquetted Iron.

How competitive?

Instead of dominating a single market of iron ore for blast furnaces, in a decade or so Australia will need to compete in three markets: those for traditional iron ore, “DR Grade” ore and “green” direct reduced iron.

Australia’s competitiveness in each of these will depend on our costs (including shipping to market) compared with those of other source countries.

We can hope to be highly competitive in “green” direct reduced iron, but this is not assured. It will depend to a significant degree on the relative cost of hydrogen here compared with other countries. We are not alone in having good solar and wind resources. China itself is building more solar and wind power capacity than all other countries combined. It may decide to produce its own hydrogen.