Pearlcasts

As we review 2025, the temptation is to look for neat summaries and settled conclusions.

Go to Pearlcasts

14 March 2026

Immigration and toxic nostalgia

A counterfactual simulation suggests Australia would be smaller, older and economically weaker today if immigration policy had remained restricted to predominantly European sources.

14 March 2026

The Age of Lies and the threat to civilisation

A global surge of misinformation – amplified by social media, AI fakery and organised disinformation campaigns – is corroding the foundations of democratic decision-making and public trust.

14 March 2026

Prevention that pays: stop ranking children and start understanding them

Standardised testing and rankings dominate school systems, but improving student wellbeing and engagement requires deeper integration between education and health support.

13 March 2026

Treatment of Iranian asylum seekers reeks of contradictions

Australia quickly offered protection to Iranian women footballers who drew global attention. At the same time, new migration laws aim to prevent other Iranian visa holders from even reaching Australia.

13 March 2026

Former defence leaders say oil wars threaten our security, and climate change deepens the danger

In full-page statements in the national media today, 19 Australian security practitioners and former Defence leaders have published an Open Letter on why Australia’s dependence on fossil fuels is a critical economic and security vulnerability.

13 March 2026

Ending native forest logging subsidies need not cost jobs

Claims that environmental reforms will destroy jobs in native forest logging are overstated. Labour market dynamics and the growth of plantation forestry point to a manageable transition.

13 March 2026

Illegal tariffs, tax cuts for the wealthy, and an unauthorised war - Part 2

Cuts to healthcare and foreign aid, combined with an unauthorised war, reveal the human consequences of fiscal and political choices now measured in lives.

13 March 2026

Louis Theroux’s Inside the Manosphere exposes the business model of misogyny

Louis Theroux's new documentary highlights how online influencers are repackaging misogyny, anti-feminism and male grievance as self-improvement – building profitable digital communities that shape how many young men understand gender and power.

13 March 2026

What Dubai reveals about diversity, order and innovation

Dubai has become a global crossroads where cultures meet within clear rules and shared systems – turning diversity into economic dynamism and social stability.

13 March 2026

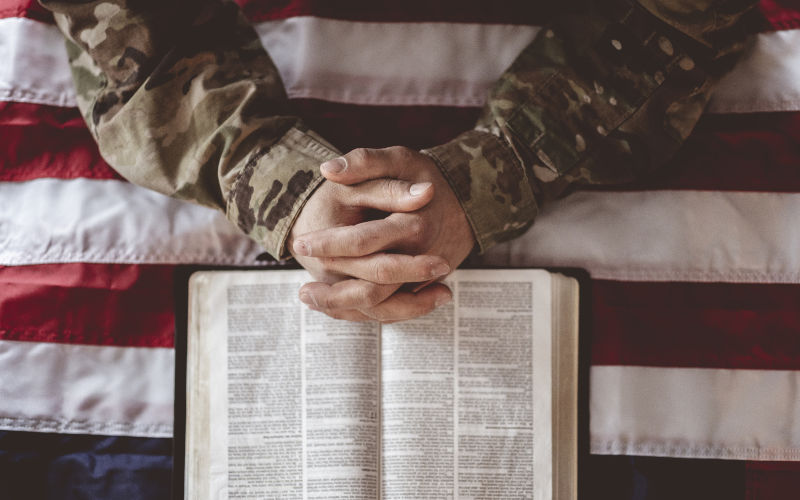

Armageddon politics and the danger of religious war rhetoric

Reports that US commanders have framed the war on Iran as part of a divine plan highlight the dangerous intersection of religious prophecy and modern military power.

12 March 2026

Off to war in West Asia we go (again)

Deploying an RAAF Wedgetail to West Asia risks making Australia a co-belligerent in the US-Israel war against Iran while exposing the country to serious strategic and economic consequences.

Read our series

Latest on Palestine and Israel

10 March 2026

The Albanese controversy shows how universities have lost their way

A cancelled venue for a UN rapporteur’s appearance highlights how universities are increasingly restricting debate about Israel and Palestine under pressure over antisemitism.

9 March 2026

Diplomacy as cover – how the road to war with Iran was paved

Negotiations with Iran appeared to promise a diplomatic breakthrough, but the launch of Operation Epic Fury suggests the talks served mainly to mask a pre-planned path to war driven by political and strategic pressure.

9 March 2026

A growing Jewish challenge to Israel’s war narrative

Jewish organisations using social media are challenging dominant narratives about Israel’s actions in Gaza, framing the conflict through human rights, international law and Jewish ethical traditions.

9 March 2026

Settler colonialism: what it can tell you about the Israel/Palestine conflict

In spite of a last minute venue cancellation by Adelaide University, a sold-out Adelaide crowd heard from Chris Sidoti, Francesca Albanese, Henry Reynolds and Lana Tatour on lessons and links for Australia on settler colonialism and the Israel/Palestine conflict. The event was hosted by Association for the Promotion of International Law (APIL).

8 March 2026

When is an illegal war morally defensible?

Some illegal uses of force have been judged morally defensible, as in Kosovo in 1999. But the US–Israel war on Iran fails that test – lacking lawful authority, credible motives and a plausible path to a better outcome.

6 March 2026

How long can Israel sustain a military conflict with Iran?

Public support for Israel’s war effort contrasts with doubts over its long-term military and economic sustainability.

6 March 2026

Australia’s politics of consensus is stifling dissent and compassion

Governments sustain power by repeating stories about themselves. In Australia’s federal parliament, a narrow political consensus – marked by conformity, cruelty and evasion – is weakening democratic debate and eroding the principles of human rights and international law.

5 March 2026

You don’t have to like Iran’s government to oppose this war

After the killing of more than 150 schoolchildren in southern Iran, memories of a visit to Isfahan in 2018 return with painful clarity for Eugene Doyle. Beyond governments and geopolitics are ordinary families, whose children now bear the cost of escalating war.

Israel's war against Gaza

Media coverage of the war in Gaza since October 2023 has spread a series of lies propagated by Israel and the United States. This publication presents information, analysis, clarification, views and perspectives largely unavailable in mainstream media in Australia and elsewhere.

Download the PDFLatest on China

11 March 2026

If China is Iran's 'most powerful ally,' then Australia must be China's

A media analysis asks why China hasn’t defended Iran. But the real puzzle is why anyone assumes Beijing has a military obligation to do so.

8 March 2026

China waits and watches as the US fights all its tigers at once

The US–Israeli war with Iran has shattered Washington’s hope of concentrating its power on containing China. Instead, the United States is entangled in multiple conflicts while Beijing gains strategic time.

7 March 2026

Message from the Editor

When I stared in newspapers it was often said that today’s paper is tomorrow’s fish and chip wrapper. It is a relief to know that some are not so casual about the press. John Menadue and Paul Keating both have long memories, and mark a special anniversary today. It is exactly three years to the day since The Age and SMH ran a series called 'Red Alert – warning war with China would come within three years, making that deadline today.

Support our independent media with your donation

Pearls and Irritations leads the way in raising and analysing vital issues often neglected in mainstream media. Your contribution supports our independence and quality commentary on matters importance to Australia and our region.

DonateMore from Pearls and Irritations

Latest letters to the editor

The coming energy crisis

Jenny Goldie — Cooma NSW

Albo's cowardice is painting a target on our backs

Richard Llewellyn — Colo Vale

Gas companies are ripping us off

Amy Hiller — Melbourne, Victoria

Australian doomcasters

Les Macdonald — Balmain NSW 2041