Pearlcasts

As we review 2025, the temptation is to look for neat summaries and settled conclusions.

Go to Pearlcasts

10 March 2026

Angus Taylor’s immigration rhetoric faces policy reality

Calls to reduce immigration by “raising standards” sound tough, but current visa settings are already far tighter than in 2022 and further cuts would come with economic costs.

10 March 2026

‘Intentional chemical warfare’: Toxic black rain in Tehran after US-Israel bomb oil facilities

Air strikes on oil storage facilities in Tehran have triggered massive fires, toxic rainfall and choking pollution, raising fears of a major environmental and humanitarian disaster.

10 March 2026

Cowardice and kowtowing risk Australia becoming the fall guy in Trump’s wars and deals

As the US–Israeli war on Iran unfolds, Australia faces the danger of being drawn into American power politics while sacrificing its independence and credibility in the region.

10 March 2026

The Albanese controversy shows how universities have lost their way

A cancelled venue for a UN rapporteur’s appearance highlights how universities are increasingly restricting debate about Israel and Palestine under pressure over antisemitism.

10 March 2026

A vessel of lies: Australian sailors implicated in the Iran War

Australian personnel aboard a US nuclear submarine during an attack on an Iranian vessel highlight the deeper implications of AUKUS – and the risk of Australia being drawn into American wars.

10 March 2026

Pacific economies exposed as war in Iran drives oil shock risk

An oil price spike triggered by war in the Middle East could hit Pacific economies hard. Heavy reliance on imported fuel and limited storage leave island nations highly exposed.

10 March 2026

Rising seas could menace a billion people this century

Accelerating sea level rise driven by warming oceans and melting ice threatens coastal cities worldwide, placing up to a billion people at risk before the end of the century.

9 March 2026

Diplomacy as cover – how the road to war with Iran was paved

Negotiations with Iran appeared to promise a diplomatic breakthrough, but the launch of Operation Epic Fury suggests the talks served mainly to mask a pre-planned path to war driven by political and strategic pressure.

9 March 2026

A growing Jewish challenge to Israel’s war narrative

Jewish organisations using social media are challenging dominant narratives about Israel’s actions in Gaza, framing the conflict through human rights, international law and Jewish ethical traditions.

9 March 2026

Settler colonialism: what it can tell you about the Israel/Palestine conflict

In spite of a last minute venue cancellation by Adelaide University, a sold-out Adelaide crowd heard from Chris Sidoti, Francesca Albanese, Henry Reynolds and Lana Tatour on lessons and links for Australia on settler colonialism and the Israel/Palestine conflict. The event was hosted by Association for the Promotion of International Law (APIL).

9 March 2026

The human side of AI in childhood cancer: children as the stress test for “good” technology

Artificial intelligence is transforming cancer care, but paediatric oncology shows why technology must be guided by transparency, ethics and the needs of children and families.

Read our series

Latest on Palestine and Israel

10 March 2026

The Albanese controversy shows how universities have lost their way

A cancelled venue for a UN rapporteur’s appearance highlights how universities are increasingly restricting debate about Israel and Palestine under pressure over antisemitism.

9 March 2026

Diplomacy as cover – how the road to war with Iran was paved

Negotiations with Iran appeared to promise a diplomatic breakthrough, but the launch of Operation Epic Fury suggests the talks served mainly to mask a pre-planned path to war driven by political and strategic pressure.

9 March 2026

A growing Jewish challenge to Israel’s war narrative

Jewish organisations using social media are challenging dominant narratives about Israel’s actions in Gaza, framing the conflict through human rights, international law and Jewish ethical traditions.

9 March 2026

Settler colonialism: what it can tell you about the Israel/Palestine conflict

In spite of a last minute venue cancellation by Adelaide University, a sold-out Adelaide crowd heard from Chris Sidoti, Francesca Albanese, Henry Reynolds and Lana Tatour on lessons and links for Australia on settler colonialism and the Israel/Palestine conflict. The event was hosted by Association for the Promotion of International Law (APIL).

8 March 2026

When is an illegal war morally defensible?

Some illegal uses of force have been judged morally defensible, as in Kosovo in 1999. But the US–Israel war on Iran fails that test – lacking lawful authority, credible motives and a plausible path to a better outcome.

6 March 2026

How long can Israel sustain a military conflict with Iran?

Public support for Israel’s war effort contrasts with doubts over its long-term military and economic sustainability.

6 March 2026

Australia’s politics of consensus is stifling dissent and compassion

Governments sustain power by repeating stories about themselves. In Australia’s federal parliament, a narrow political consensus – marked by conformity, cruelty and evasion – is weakening democratic debate and eroding the principles of human rights and international law.

5 March 2026

You don’t have to like Iran’s government to oppose this war

After the killing of more than 150 schoolchildren in southern Iran, memories of a visit to Isfahan in 2018 return with painful clarity for Eugene Doyle. Beyond governments and geopolitics are ordinary families, whose children now bear the cost of escalating war.

Israel's war against Gaza

Media coverage of the war in Gaza since October 2023 has spread a series of lies propagated by Israel and the United States. This publication presents information, analysis, clarification, views and perspectives largely unavailable in mainstream media in Australia and elsewhere.

Download the PDFLatest on China

8 March 2026

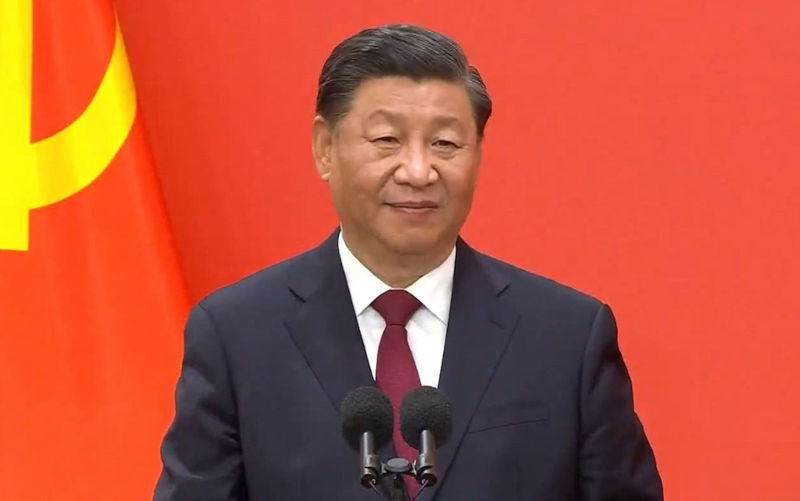

China waits and watches as the US fights all its tigers at once

The US–Israeli war with Iran has shattered Washington’s hope of concentrating its power on containing China. Instead, the United States is entangled in multiple conflicts while Beijing gains strategic time.

7 March 2026

Message from the Editor

When I stared in newspapers it was often said that today’s paper is tomorrow’s fish and chip wrapper. It is a relief to know that some are not so casual about the press. John Menadue and Paul Keating both have long memories, and mark a special anniversary today. It is exactly three years to the day since The Age and SMH ran a series called 'Red Alert – warning war with China would come within three years, making that deadline today.

7 March 2026

Three years on, where is the China war we were warned of?

Three years after dire warnings that Australia must prepare for war with China, no such conflict has eventuated. Instead, the United States has continued its long pattern of military interventions.

Support our independent media with your donation

Pearls and Irritations leads the way in raising and analysing vital issues often neglected in mainstream media. Your contribution supports our independence and quality commentary on matters importance to Australia and our region.

DonateMore from Pearls and Irritations

Latest letters to the editor

Thanks to John Menadue on the 'Red Alert' anniversary

Margaret Callinan — Hawthorn VIC 3122

Robowar

Geoff Taylor — Borlu (Perth)

Antisemitisim Royal Commission and free speech

David Griffiths — Mordialloc, Victoria 3195

An Australian Pledge

Peter Bolton — nsw