Pearlcasts

As we review 2025, the temptation is to look for neat summaries and settled conclusions.

Go to Pearlcasts

1 February 2026

Mark Carney – Values: an economist's guide to everything that matters

Mark Carney argues that treating price as a proxy for value has driven crises in finance, health and climate. His book offers a roadmap for rebuilding trust, fairness and resilience.

1 February 2026

Vaccination, misinformation and the damage done by US policy shifts

The United States’ retreat from evidence-based vaccination policy is accelerating vaccine hesitancy at home and abroad. As misinformation gains official backing, the consequences for public health are already becoming visible – and Australia is not immune.

1 February 2026

Environment: Agricultural emissions are roasting the planet

Together, 45 global livestock companies produce more greenhouse gases than all but eight countries. Plus, crimes against nature are big business that rely on criminal networks, corrupt officials and eager customers, and global warming marches on.

1 February 2026

Does killing dingoes make K’gari safer for people?

The Queensland government’s decision to cull dingoes on K’gari after a tragic fatal incident has sparked debate about public safety, conservation and whether killing wildlife reduces risk to visitors.

1 February 2026

How much federal income tax will Elon Musk’s Tesla pay on $5.7 billion in 2025 revenue? $0

The Trump administration and Republicans in Congress “have allowed a hugely profitable corporation to avoid paying even a dime of federal income tax on their 2025 US profits.”

31 January 2026

Greenland and western hypocrisy over the rules-based international order

Western leaders defend the rules-based international order when it suits them, but remain largely silent as those same rules are breached by the United States and Israel. The result is a system that shields the powerful and abandons the vulnerable – most starkly in Palestine.

31 January 2026

Message from the Editor

Hello all – I hope you got some much-needed respite during what turned out to be a January full of grief and turmoil for so many.

31 January 2026

Historic trade deal rejects Trump’s chaotic protectionism – Asian Media Report

The mother of all trade deals to America’s new defence strategy, the dismissal of a PLA princeling, Prabowo’s Peace Board support, ASEAN’s rejection of Myanmar junta’s poll victory and the deadly serious business of marriage in China – we present the latest news and views from our region.

31 January 2026

Historic trade deal rejects Trump’s chaotic protectionism – Asian Media Report

The mother of all trade deals to America’s new defence strategy, the dismissal of a PLA princeling, Prabowo’s Peace Board support, ASEAN’s rejection of Myanmar junta’s poll victory and the deadly serious business of marriage in China – we present the latest news and views from our region.

31 January 2026

The most important power station in the nation is no longer a coal plant – it’s on our rooftops

Australia’s electricity grid is increasingly being powered by rooftop solar, batteries and renewables, exposing the limits and rising costs of ageing coal-fired power stations.

31 January 2026

As Marmite Morrissey returns, let’s talk about the actual music

When news broke of a new Morrissey single and album (both titled Make-Up is a Lie), one thing was assured: it was going to get people talking.

Read our series

Latest on Palestine and Israel

29 January 2026

A war without headlines

The annihilation of Gaza has rendered the violence in the West Bank seemingly secondary in the global imagination.

26 January 2026

From international law to loyalty and deals: Trump’s Board of Peace play

The Trump-led Board of Peace points to a shift away from international law and multilateral institutions toward a system built on loyalty, coercion and financial leverage.

24 January 2026

Cultural “cohesion” becomes censorship, and a festival falls apart

Adelaide Writer’s Week was derailed after the withdrawal of an invited speaker, triggering mass author withdrawals and a board resignation. The episode raises hard questions about free speech, institutional courage, and the politics of Israel and Gaza in Australia’s cultural life.

23 January 2026

Bad laws are the worst sort of tyranny – and this one ticks every box

A sweeping new bill to combat antisemitism, hate and extremism was rushed through federal parliament this week with minimal scrutiny and major rule-of-law flaws. Its vague definitions, retrospective reach and expanded executive powers risk undermining rights, due process and democratic accountability.

20 January 2026

The rules are breaking – and the world is watching

The abduction of Venezuela’s president signals a world where power is replacing law, and impunity is setting the pace.

18 January 2026

Best of 2025 - Gaza’s economy has collapsed beyond recognition

Gaza’s economy, society and basic infrastructure have been almost entirely wiped out. With 90 per cent of people displaced, food systems destroyed and schools and hospitals in ruins, reconstruction is becoming harder by the day.

16 January 2026

Banning slogans won’t build social cohesion

After Bondi, New South Wales politicians want to ban words and slogans. But rushed laws could punish political speech, not protect the public.

16 January 2026

Iran in the vortex: what's really happening

As protests unfold in Iran, Israeli and US figures openly talk of regime collapse. Foreign interference risks worsening violence and derailing change from within.

Israel's war against Gaza

Media coverage of the war in Gaza since October 2023 has spread a series of lies propagated by Israel and the United States. This publication presents information, analysis, clarification, views and perspectives largely unavailable in mainstream media in Australia and elsewhere.

Download the PDFLatest on China

31 January 2026

Historic trade deal rejects Trump’s chaotic protectionism – Asian Media Report

The mother of all trade deals to America’s new defence strategy, the dismissal of a PLA princeling, Prabowo’s Peace Board support, ASEAN’s rejection of Myanmar junta’s poll victory and the deadly serious business of marriage in China – we present the latest news and views from our region.

31 January 2026

Historic trade deal rejects Trump’s chaotic protectionism – Asian Media Report

The mother of all trade deals to America’s new defence strategy, the dismissal of a PLA princeling, Prabowo’s Peace Board support, ASEAN’s rejection of Myanmar junta’s poll victory and the deadly serious business of marriage in China – we present the latest news and views from our region.

31 January 2026

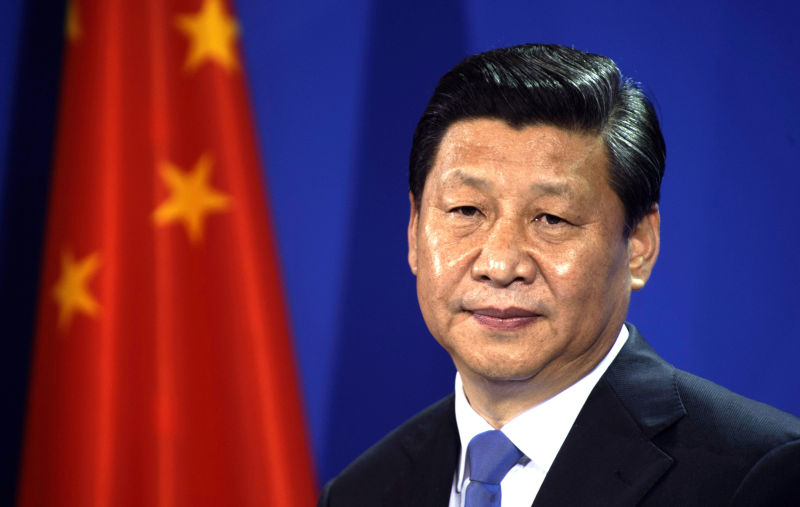

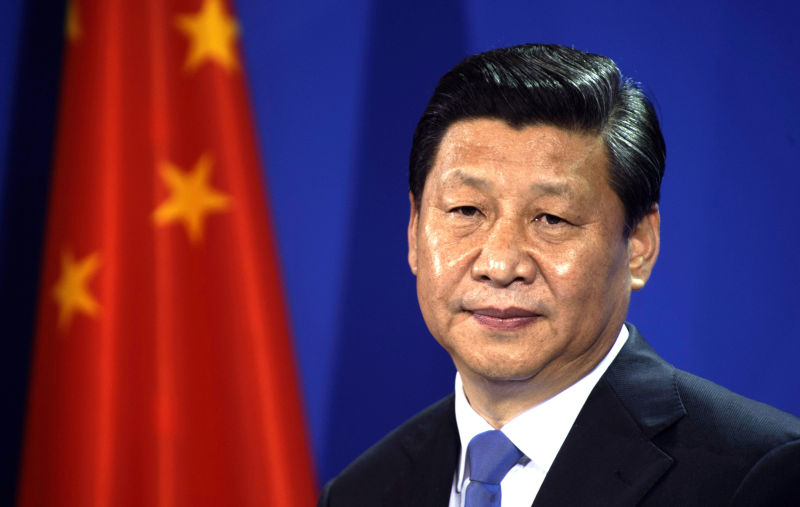

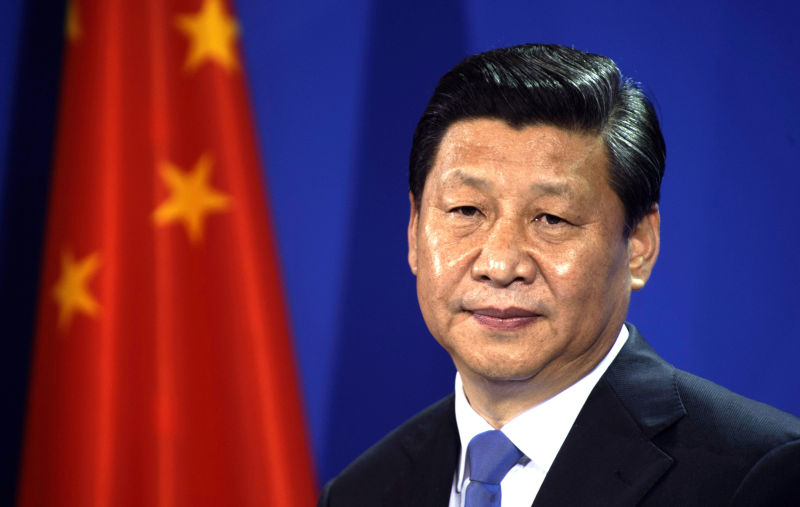

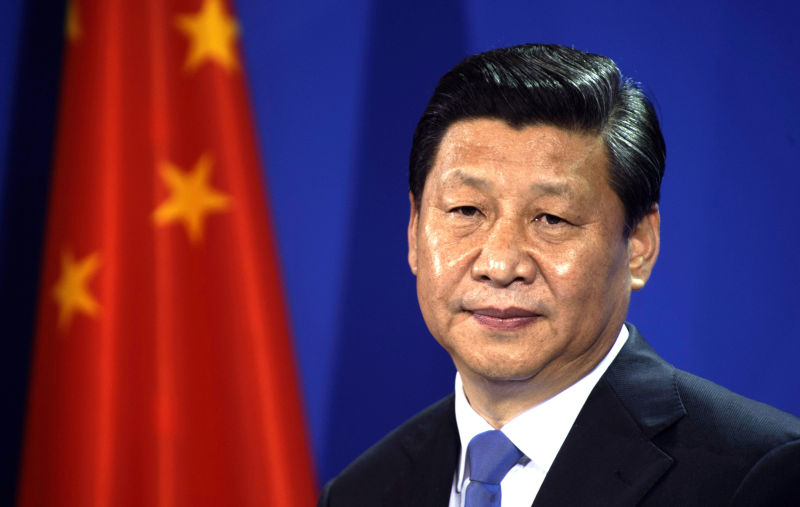

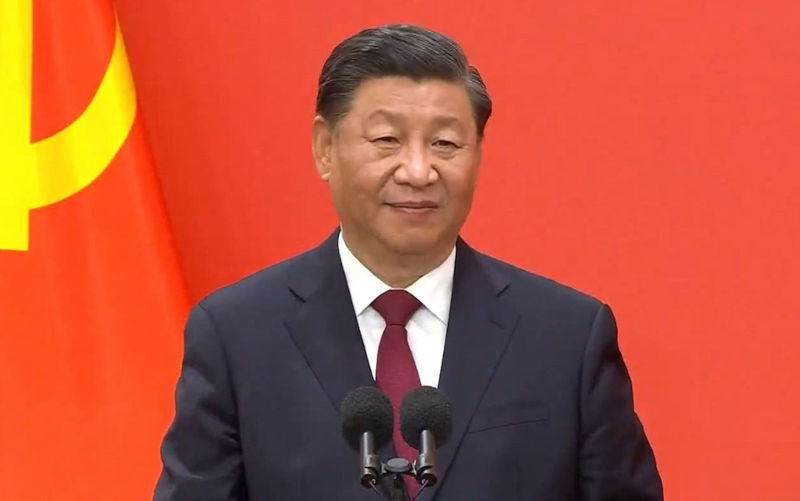

China’s swift ousting of Zhang Youxia is a sharp warning on party purity from Xi

Seemingly risky move to oust two generals ahead of Communist Party congress and PLA centenary sends a message about anti-corruption drive.

Support our independent media with your donation

Pearls and Irritations leads the way in raising and analysing vital issues often neglected in mainstream media. Your contribution supports our independence and quality commentary on matters importance to Australia and our region.

DonateMore from Pearls and Irritations

Latest letters to the editor

A passive electorate may revolt

Ian Bowrey — Hamilton South

Future industries – a question mark?

Ian Bowrey — Hamilton South

The courage to join Canada

Tony Simons — Balmain NSW

Could you imagine

Hal Duell — Alice Springs