6 July 2025

Gunning for the Greens over Gaza - Part 1

After the federal election on 3 May, dissection of the Liberals’ turmoil received top billing.

6 July 2025

Spiritual malpractice: The Vatican's dodgy saint-making business

Pope Leo rubberstamps the controversial canonisation of a multimillionaire Italian's adolescent son.

6 July 2025

Environment: Ken Henry and Xi Jinping agree nature is critical to productivity

Ken Henry says high-integrity environmental laws will be the government’s first test but new Labor MPs don’t agree. Great Barrier Reef still suffering from heat, agricultural run-off and overfishing. NATO to increase its spend and its emissions.

Support our independent media

Pearls and Irritations is funded by our readers through flexible payment options. Choose to make a monthly or one off payment to support our informed commentary

Donate

6 July 2025

Mamdani’s magnificent primary win – What follows

People are asking about my reaction to Zohran Mamdani’s spectacular and decisive upset in the Democratic primary victory for Mayor of New York over ex-Governor Andrew Cuomo.

6 July 2025

The takeaway from the Venice Biennale saga: the art world faces deep and troubling structural inequality

Creative Australia’s decision earlier this year to rescind the selection of artist Khaled Sabsabi and curator Michael Dagostino as Australia’s 2026 representatives at the Venice Biennale sent shockwaves through the arts sector.

5 July 2025

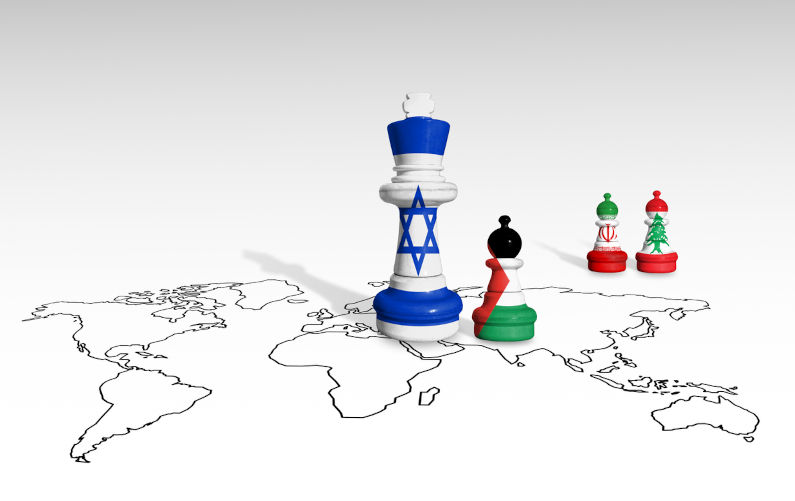

Israel: The true superpower? Journalist exposes global threat in explosive Sydney talk

In a searing address to a sold-out crowd in Sydney on Saturday night 28 June 2025, award-winning Australian investigative journalist Antony Loewenstein declared that Israel has quietly become the world’s most dangerous superpower, wielding weapons, surveillance technology, and AI systems perfected on Palestinians to control populations across many countries.

5 July 2025

Trump tariff deals with Japan, India bogged down – Asian Media Report

In Asian media this week: Trade pact sealed with Vietnam. Plus: Dalai Lama at 90 – the institution will continue; Region’s newspapers show disdain for NATO; China, Pakistan setting up new South Asian bloc; Canberra, Beijing squabble over project naming rights.

5 July 2025

Trump’s Big Ugly Bill is fascism in writing

It establishes an anti-immigrant police state in America, replete with a standing army of ICE agents and a gulag of detention facilities, and it was passed by a narrow margin despite popular opinion.

5 July 2025

Flood management: Science, technology and people’s responses

To reduce the risks posed by floods requires both scientific input and appropriate community reaction. It is not always clear that both are in evidence.

5 July 2025

Fifteen years of UN Women: A call to action, not complacency

Fifteen years ago, UN Women was established with a bold mission: to drive real and lasting change for all women and girls.

5 July 2025

World Bank warns that changes are coming in the global economy

The World Bank’s just released flagship report Global Economic Prospects sounds a warning for the global economy, which is projected to slow dangerously through the next few years, while also showing substantial changes.

Latest on Palestine and Israel

6 July 2025

Gunning for the Greens over Gaza - Part 1

After the federal election on 3 May, dissection of the Liberals’ turmoil received top billing.

4 July 2025

Genocide in Gaza: History repeats itself

For the past 21 months, I have endured the painful experience of displacement, moving between tents under relentless bombardment in Gaza.

4 July 2025

Food aid or firing squads?

In Gaza today, hunger has a price – and for far too many civilians, that price has been death.

3 July 2025

UN report lists companies complicit in Israel’s ‘genocide’. Who are they?

The United Nations special rapporteur on the situation of human rights in the occupied Palestinian territory (oPt) has released a new report mapping the corporations aiding Israel in the displacement of Palestinians and its genocidal war on Gaza, in breach of international law.

3 July 2025

Israel’s genocide and German Staatsräson: Thwarting a youth’s political sensibilities

It was the third month of Israel’s genocidal onslaught in Gaza, just before the Christmas break in 2023, when my daughter Lelia came home one day and mentioned an unhappy confrontation with one of the directors of her school, the Freie Waldorfschule Berlin Mitte.

2 July 2025

Gaza’s Hunger Games

Israel is weaponising starvation. The objective is to dismantle all remnants of civil society and reduce Palestinians to herds of desperate scavengers who can be driven from historic Palestine.

2 July 2025

Flour instead of homeland: manufacturing the crisis and the end of the Palestinian dream

Since 4:00 p.m. on 14 May 1948, the Palestinian cause has been one of a homeland seized by force, a land torn from its people by Zionism through weapons and terror.

2 July 2025

Courage needs to be shown in politics – Israel is no longer above the law

In the past weeks, an estimated 500 more Gazans have been killed, bombed out of existence by the IDF or killed while queuing for food.

Israel's war against Gaza

Media coverage of the war in Gaza since October 2023 has spread a series of lies propagated by Israel and the United States. This publication presents information, analysis, clarification, views and perspectives largely unavailable in mainstream media in Australia and elsewhere.

Download the PDFLatest on China

4 July 2025

China’s rapid adoption of AI demands greater scrutiny of the social impact

In contrast to the perception that Beijing has placed a lot of guardrails on AI, China’s AI regulation so far has been limited.

30 June 2025

China is taking Silicon Valley’s market ‘hacks’ to a whole new level

From blitzscaling to leveraging network effects, China is using the same methods to dominate supply chain and disrupt markets.

28 June 2025

No time to dye: ABC’s China bias is licensed to kill credibility

The ABC has long held a reputation as Australia’s sober, publicly-funded bulwark against tabloid sensationalism – the broadcaster you turn to when you want analysis, not alarmism.

Support our independent media with your donation

Pearls and Irritations leads the way in raising and analysing vital issues often neglected in mainstream media. Your contribution supports our independence and quality commentary on matters importance to Australia and our region.

DonateMore from Pearls and Irritations

Latest letters to the editor

International law: Who in Australia cares?

John Queripel — Newcastle

Gaza genocide

Dieter Barkhoff — Victoria

Chilling words

Tom Knowles — Parkville Vic

No mention of lobbyists?

Glenda Jones — Carlton 3053